We have not focused on the lithium space so far but we are getting super excited about lithium miners right now. Lithium Americas Corp, one of the leading lithium miners, flashes a buy signal for 2018. This article gives details on an attractive entry price, and which conditions should be met before buying this lithium stock.

Last summer we wrote in this article Commodities Still Weak Except Some Base Metals that “being selective in commodity investing is a success factor. Some base metals are acting strongly right now. Think of copper and zinc primarily, as well as some niche metals like lithium. Those base metals are greatly outperforming all other commodities.”

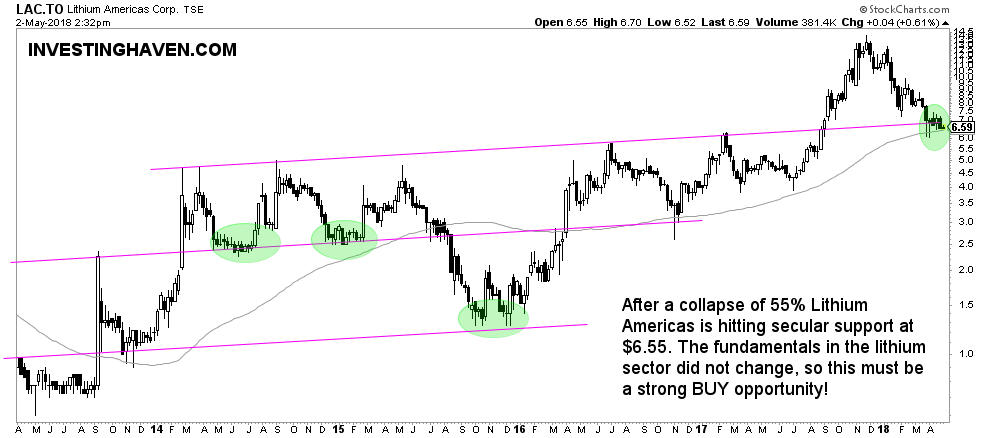

The chart of Lithium Americas Corp is embedded below. This $500M market cap lithium company rose sharply from $4 last summer to $14 early 2018, a multi-bagger in half a year.

Its chart may be volatile but it has one direction on the long run: higher.

Interestingly, there is a clear pattern that marks this lithium stock: several levels (channels) in which it moves with clear tests as support and resistance.

We have highlighted the BUY areas in green. Every time former resistance / new support is tested it is a buy opportunity. Note, however, one very important characteristic: a buy opportunity only sets up if the support area is (1) very strong (2) tested during 3 to 4 months!

In other words, the current price level of lithium stock Lithium Americas Corp looks very enticing as it is testing a very strong support area but it has not yet tested this level for more than one month. If its stock price continues to trade in the $6 to $7.5 area until June / July of 2018, and starts breaking out this summer, it will be a very strong BUY signal to invest in 2018.

Leave A Comment