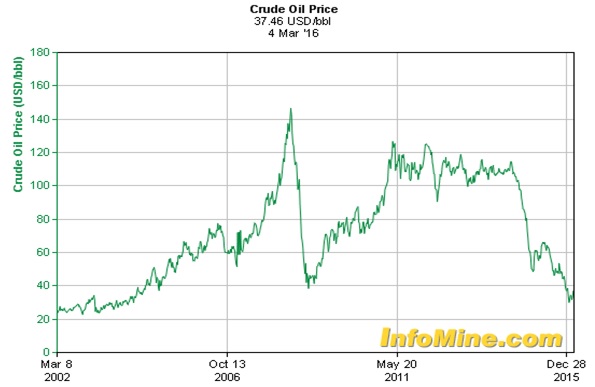

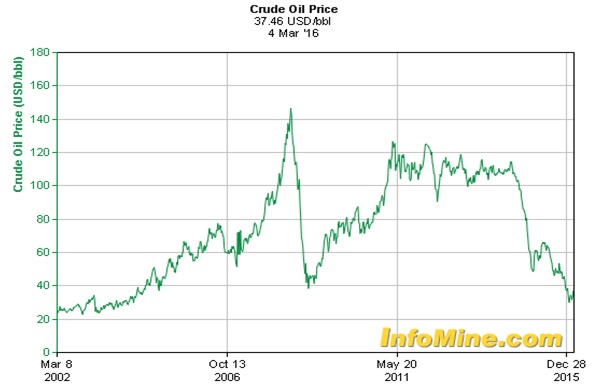

The energy sector has been mired in a historic decline of crude oil prices essentially since 2014. This has largely been due to an oversupplied market in the face of relatively flat global demand. Of the 90 million barrels of crude oil supplied globally each day, it is estimated that there are approximately 800,000 barrels of oversupply. Saudi Arabia, in particular, continues to oversupply an already oversupplied market. As a result of this oversupply condition (which could be exacerbated with additional supply being exported from the likes of Iran and the U.S.), oil prices hit a 12 year low early in 2016 and even traded below $30 per barrel at one point.

Source: InvestmentMine, March 4, 2016. Past performance is not an indication of future results.

This has led many strategists to suggest that a bottom in oil prices has been established and that now may be the time to start investing again in the energy sector, and more specifically in oil related investments. Interestingly, oil has rallied in early March with Brent Blend (Brent) crude oil prices touching $40 a barrel. It may be helpful at this point to explain the differences between the two commonly quoted oil prices based upon information found on Investopedia.

• Brent Blend (Brent) – Roughly two-thirds of all crude contracts around the world reference Brent Blend, making it the most widely used marker of all. These days, “Brent” actually refers to oil from four different fields in the North Sea: Brent, Forties, Oseberg and Ekofisk. Crude from this region is light and sweet, making them ideal for the refining of diesel fuel, gasoline and other high-demand products.

• West Texas Intermediate (WTI) – WTI refers to oil extracted from wells in the U.S. and sent via pipeline to Cushing, Oklahoma. The fact that supplies are land-locked is one of the drawbacks to West Texas crude – it’s relatively expensive to ship to certain parts of the globe. The product itself is very light and very sweet, making it ideal for gasoline refining, in particular. WTI continues to be the main benchmark for oil consumed in the United States.

Leave A Comment