Slack In The Labor Market

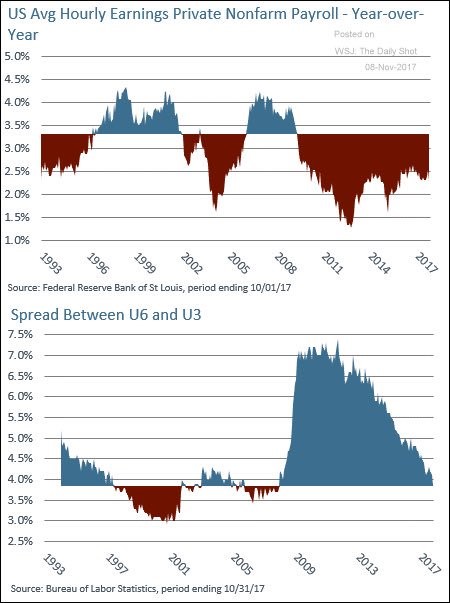

We’ve discussed wage growth in many articles. The chart below is a great depiction of what might occur in the next few months. It shows the spread between the U6 unemployment rate and the U3 unemployment rate. This shows the amount of people who are underemployed. The axis where the colors reverse is at 4% because there’s always going to be some workers in that category. When there’s less than 4%, it signals wage growth will accelerate. When there’s more than 4%, it signals wage growth will stay low. As you can see, the point where the colors change in the top chart is about 3.3% which shows that whenever the slack is low, wage growth is more than 3.3% and whenever the slack is high, growth is below 3.3%. With the slack about to be completely diminished, it looks like wage growth will get closer to 3% and eventually go above 3.3%. That would be a catalyst for core inflation to jump above the 2015 high. We discussed how Morgan Stanley expects core PCE to stay below the previous high. I’m not sure what they expect wage growth to be, but wage growth will definitely heat up inflation and cause the Fed to raise rates again.

Bitcoin Explodes

In the past I’ve recommended bitcoin, but with its meteoric rise, it’s time to avoid it completely. There’s no reason to buy into something that rises this quickly. There’s no question it will fall back down as speculators take profits. Many people will be willing to sell as it falls because they will want to lock in their gains. The story of bitcoin is interesting because it can’t be devalued like fiat currencies. However, the usage hasn’t increased enough this year to justify its price increase. Because using it to buy things is effectively selling the cryptocurrency, the size of the price increase might be discouraging people for using it. The speculative frenzy is the least interesting part about bitcoin.

Leave A Comment