Let me start out by saying I hate market comparisons.

While history certainly does “rhyme,” they are never the same. This is especially the case when it comes to the financial markets. Chart patterns may align from time to time, but such is more a function of pattern-fitting than anything else.

However, when it comes to fundamentals, standard-deviations, extensions, etc., it is a different story. A recent articleby Ryan Vlastelica brought this to mind.

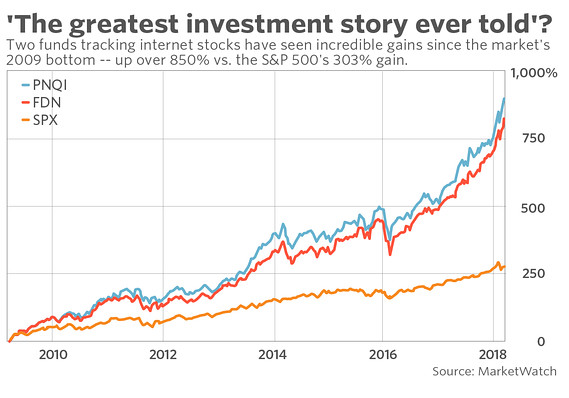

“While the strategy of investing in internet-related companies will likely always be first associated with the dot-com era, the long-lived bull market has proved to be just as strong a period for a sector that has influenced nearly every aspect of the economy.

Friday marks the ninth anniversary of the financial crisis bottom, and since that period—by one measure, the start of the current bull market—internet stocks have been among the best performers on Wall Street.”

“’The current tech rally is possibly the greatest investment story ever told,’ wrote Vincent Deluard, global macro strategist at INTL FCStone, who was speaking about the sector broadly, and not these ETFs in particular. He noted that the MSCI World Technology Index has added $5.7 trillion in market capitalization since February 2009, ‘when the entire sector amounted to just $1.5 trillion.’”

Since Ryan was probably in elementary school during the “Dot.com” era, and many current fund managers weren’t managing money either, it is easy to dismiss “history” under a “this time is different” scenario. Even the ETF’s used as an example of the “this time is different” scenario didn’t even exist prior to the “dot.com bubble” (The QQQ didn’t come into existence until 1999)

Unfortunately, while the names of the companies may have changed, the current “dot.com boom” is likely more than just a “rhyme” with the past.

Investors Once Again Being Misled

From a fundamental basis, there is a difference between today and the “Dot.com days of yore.” In 1999, “dot.com”companies were all bunched together and few actually made money. Fast forward to 2018, and the division between an “internet company” and every other company is now invisible. In fact, companies like Apple and Amazon are no longer even classified as “technology” companies but rather consumer goods companies.

Leave A Comment