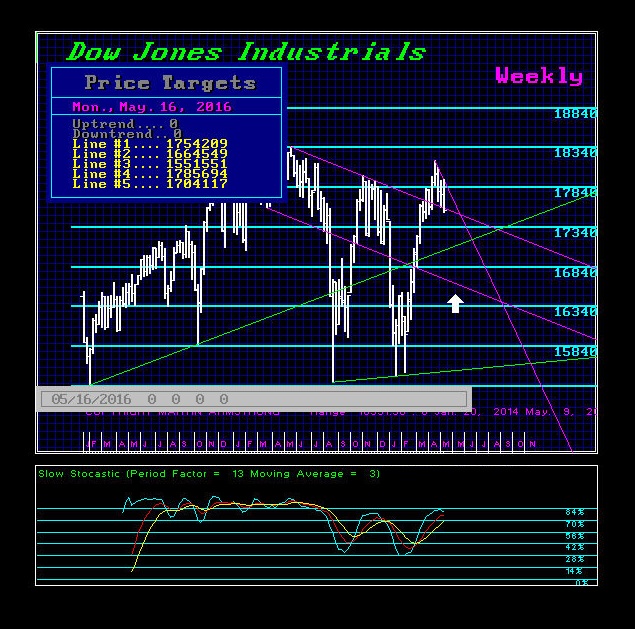

The first Minor Weekly Bearish Reversal in the Dow lies at 17434. A closing beneath this for the week will confirm what already appears to be in motion technically as well as after electing three Daily Bearish Reversals. The next critical area is really 17120 which happens to be a Daily and Weekly Bearish Reversal. This is the primary support. Breaking this area then opens the door for a more sharp drop ahead to retest 16000.

We have a more important number for month-end and that is 17579 followed by 17210. A May close below this level will confirm a correction into the August/September period, which can extend even into early 2017. This should produce a retest of the broader support at 16000 and a breach of that level on a monthly closing basis would set the stage for a new low under that of 2015.

Keep in mind the Fed realizes that it needs desperately to restore some “normalization” to interest rates. The Fed is departing from Draghi who is destroying the future of Europe as is the Bank of Japan. This is really turning into the Clash of Titans. This is also unfolding is helping to keep the dollar as the only game in town.

Last week, the Dow closed BELOW the technical support I warned had to hold on any retest, which it did not. This was the market warning that between the chaos of the elections, the BREXIT vote in June, and the Fed realizing it has to raise interest rates to try to ward-off the growing demands to seize all pension funds in the nation to bailout public pensions in the various States, the future looks a bit cloudy at best.

We need to watch gold as well. If gold exceeds last year’s high of 1307.80, the likelihood of a sustain breakout beyond 1360 is not very good with a strong dollar. However, such move would also confirm an extension of this entire mess and any reversal where there is a sudden crisis in confidence in government within the main segment of the population would probably come in 2017. This makes sense from the perspective of 2017 being the year from Political Hell. It also would not rule out the ultimate swing for gold to crash to new lows really twisting the minds of everyone with rising rates and the dollar.

Leave A Comment