The recent increase in junk bond yields is a warning sign that recession risk is rising, says Martin Fridson, a money manager at Lehmann Livian Fridson Advisors. “I am not an economic forecaster — this is what the market is saying,” he told Bloomberg on Tuesday. “There are lots and lots of caveats, but if you accept all of the assumptions, it’s a pretty startling comment,” says this respected veteran of all things high-yield-bond related.

Fridson’s methodology for estimating recession risk via junk bonds is summarized as follows via the Bloomberg article:

Fridson’s analysis looks at monthly junk-bond spreads since 1986, using Bank of America Merrill Lynch index data. The extra 7.39 percentage points investors demanded to hold high-yield debt over Treasuries on Jan. 8 was somewhat less than midway between the 5.2 percentage point-average for expansionary months and 10.19 percentage point-average for recessionary months. That signals the probability of a recession at 43.9 percent, according to the Tuesday report from Standard & Poor’s Capital IQ Leveraged Commentary & Data.

Let’s run a data check with a different approach for estimating recession risk using junk bonds, followed by a look at additional indicators from elsewhere in the markets and the economy. As a preview, the signals suggest that business-cycle risk is elevated relative to levels in recent years but still well short of a clear tipping point in terms of estimating probabilities for an NBER-defined recession.

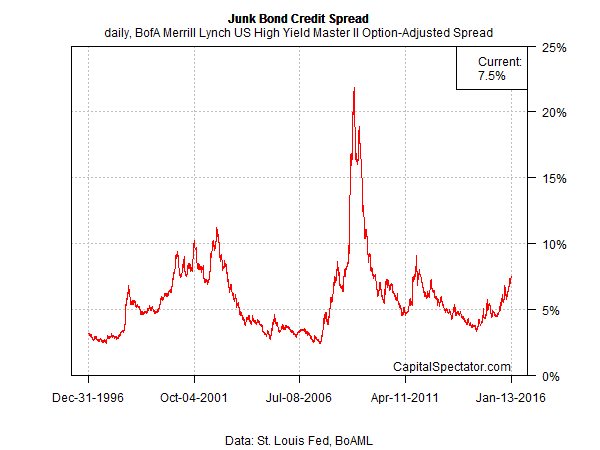

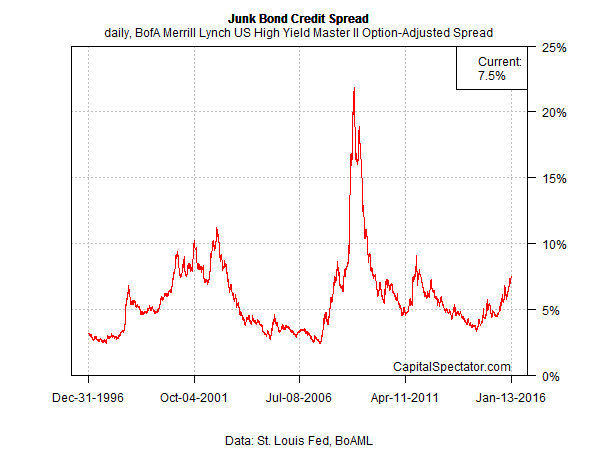

First, here’s how the raw high-yield spread stacks up at the moment through yesterday (Jan. 13) via the BofA Merrill Lynch US High Yield Master II Option-Adjusted Spread. Yesterday’s 7.50% spread reading is the highest since late-2011 but far below–so far–the heights reached in the last recession.

Crunching the numbers in a probit model and analyzing the results in context with NBER’s business cycle history estimates the current probability of recession at roughly 16%. That’s the highest since 2011, but it’s still low enough to refrain from announcing that a new downturn is fate. Nonetheless, it’s clear that the numbers are moving in the wrong direction these days.

Leave A Comment