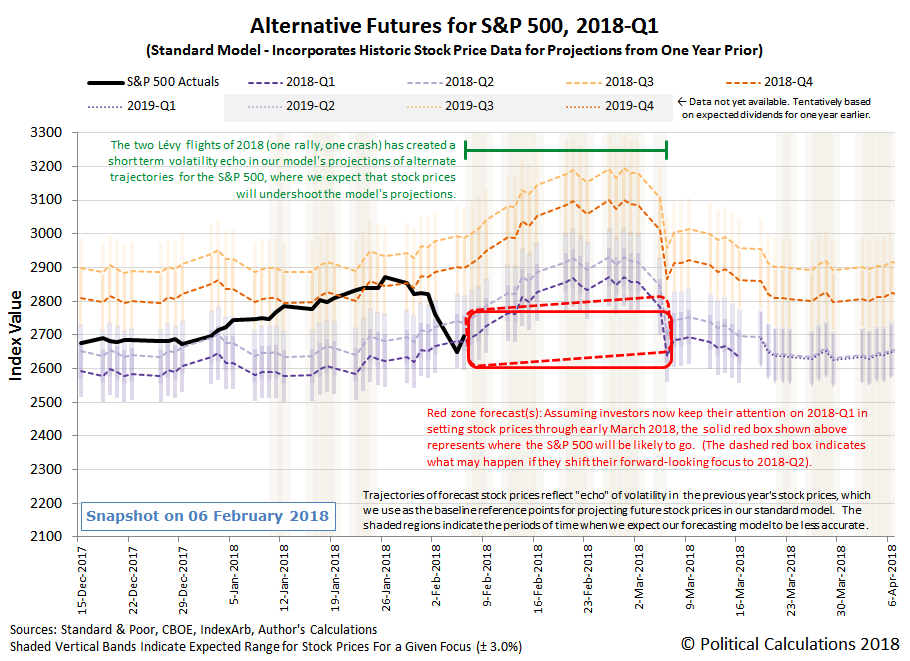

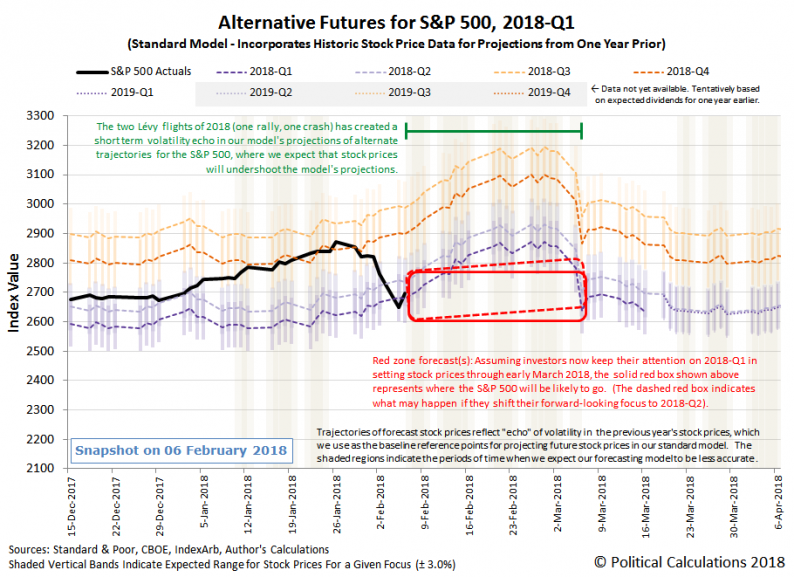

From the end of trading on Friday, 26 January 2018 when it closed at its all time high of 2,872.87 to the market close on Tuesday, 6 February 2018 when it rebounded from the previous day’s crash to close at 2,695.14, we estimate that the S&P 500 lost over $15.9 trillion of its market capitalization. Since that’s a lot of money to have so suddenly evaporated over the last seven trading days, we imagine that a lot of investors are asking if Tuesday’s rebound marks the end of the market carnage.

Nobody will know the answer for sure for some time yet, but we do see an intriguing possibility that it has. If we’re right, and the sudden, sharp drop and highly volatile trajectory of stock prices has indeed all been part of a Lévy flight event, it may indeed be over except for some higher-than-typical levels of daily volatility, because it would appear that investors have completed shifting their forward-looking attention from the distant future quarter of 2018-Q4 all the way back to the current quarter of 2018-Q1, since such shifts in forward-looking focus are the drivers of this kind of volatility in our dividend futures-based model of how stock prices work.

Our alternative futures chart above updates and modifies the Lévy flight event we first presented back in the early hours of Monday, 5 February 2018. Let’s talk through the updates:

Leave A Comment