Although I am sure they were some traders advocating shorting the US dollar into the Trump bump, they sure seemed few and far between (apart from this badass cat who nailed the trade and is now covering into the USD weakness).

In fact, when I think about the opinions from the “cool kids” over the past six months, I can only recall all-out-bulls, or unsure fence sitters. Name me a big-name US dollar bear pounding the table – none spring to mind.

And in the heyday period following Trump’s election, the US dollar bullishness was downright exuberant.

“Super dollar bull market” was a recurrent theme amongst the myriad of bulls who were convinced the US dollar was headed to the moon. Whether it was due to Trump’s supposed superb business acumen, or the acceleration of the emerging market USD debt obligation payback vicious circle, all these bulls had their own reasons why greenback would continue to appreciate.

Well, had did it turn out?

A complete dud. Trump’s inauguration proved to be the top, and it has been nothing but downhill since then. I am actually quite mad at myself, fading this consensus trade proved to be one of the greatest trades of 2017 (and yet another example of how in this day of limited alpha, the best trade is fading the crowd).

Yet the interesting part of this extended move? No one is getting excited about it. I pulled up my composite speculative positioning of CME currency positions, and it is pretty well zero. US dollar specs are almost as flat as your uncle’s drunken campfire singing at a cottage long weekend.

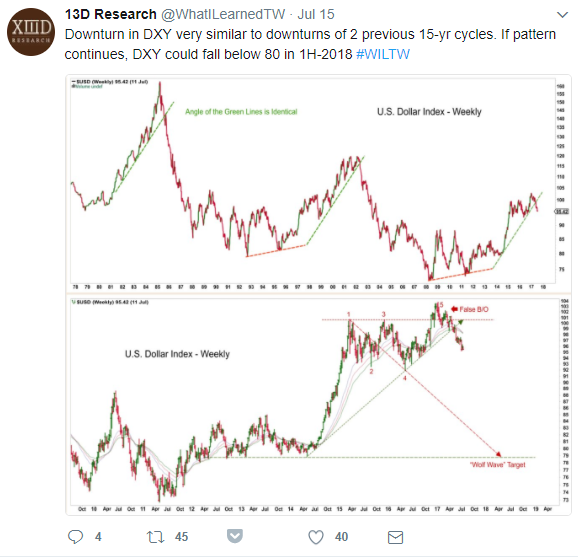

Recently, two terrific, must-follow, twitter traders were discussing this situation. 13D Research, author of the terrific What I learned this week, first made a comment about the possibility of this US Dollar move continuing.

But then, Luke Gromen, who pens Forest for the Trees, chirped in with a comment I felt was especially apt.

Leave A Comment