Before this article receives hate comments from both bullish and bearish investors, the purpose of this article is to discuss the average historical and projected lifespan of companies included in the S&P 500 index, as well as discussing whether the S&P 500 should be considered as an active manager going forward, rather than a passive manager.

The theory of disruption in business is that competition doesn’t only come from businesses who are in the same industry, but can also arise from completely different industries. One example of this is movie streaming disrupting movie renting stores and movie theaters. The reason disruption is so heavily studied and has become a buzzword in investing is that it can come from seemingly nowhere and take market share from established brands. Companies which spent years developing their brands can see their business disappear almost overnight. It’s like a black swan event except with industries not the economy. If you’re an investor, it might not be enough to just look at the competition. You need to look at how technology can destroy a business.

Companies Are Dropping Out Of The S&P 500 Index Quicker

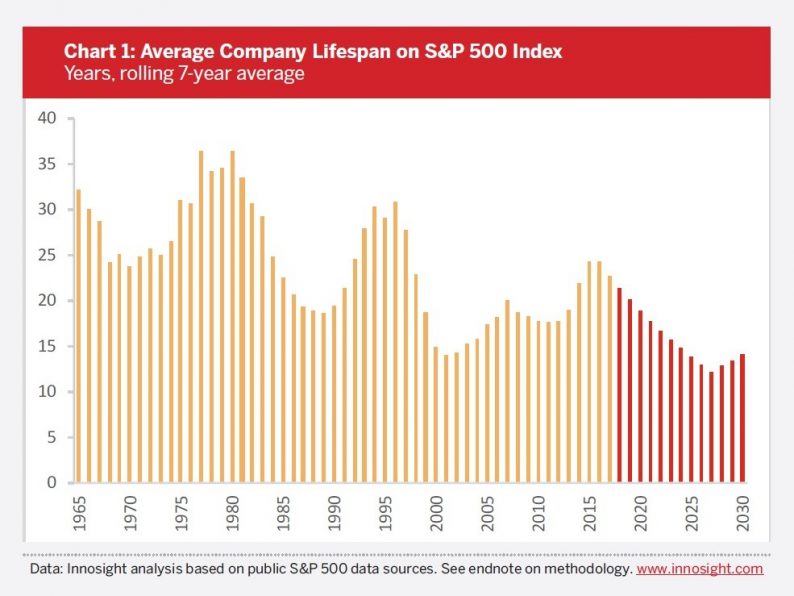

The chart below provides great clarity into the importance of disruption.

Lifespan Of Firms Shrinking

The lifespan of companies has been falling for a few decades. There are cyclical changes as more companies fail during recessions and less fail when times are good. However, let’s ignore those small changes and look at how the average company now only stays in the index for about 20 years instead of 30 years. The internet makes disruption easier than ever before because scaling business growth is easier and faster. Companies are gaining billion dollar market caps in less time than ever. For example, a small team consisting of only a few programmers can develop a game for mobile devices which successfully competes with mega corporations’ games which have taken millions of dollars and years to develop. It’s possible that marketing is less impactful than in prior generations because product reviews have become a more meaningful part of any purchase decision. This efficiency makes it more difficult to protect a market share moat. The internet is making competition fiercer, especially in retail.

Leave A Comment