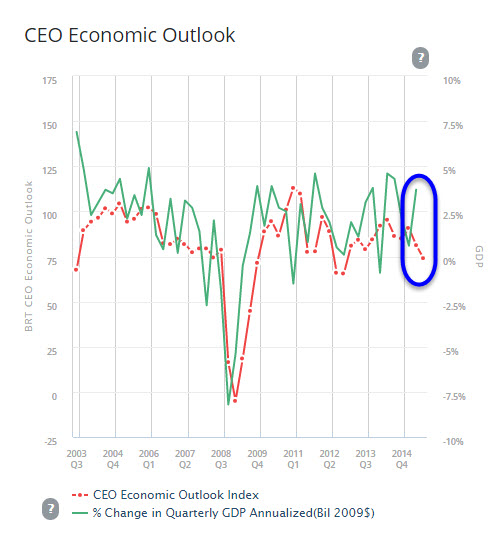

Despite all the confidence-inspiring propaganda from any and every mainstream talking-head, CEOs are cautious about the U.S. economy’s near-term prospects and are trimming business plans for hiring and capital investment over the next six months. According to The Business Roundtable, the CEO Economic Outlook Index tumbled 7.2 pts, from 81.3 in Q2 to 74.1 in Q3…

“The downward trend in CEO plans for investment and hiring continues to reflect reasonable caution regarding near-term prospects for modest U.S. growth,” said Randall Stephenson, chairman of Business Roundtable and chairman and CEO of AT&T Inc. Stephenson noted that business plans could be negatively affected if Washington fails to act on federal budgets, the debt ceiling and tax extenders.

“Predictability is critical to spur investment and unlock economic expansion and job growth,” Stephenson said. “Congress and the Administration need to work together to pass a prudent spending plan and renew expired tax provisions. U.S. workers cannot afford the instability that comes with inaction.”

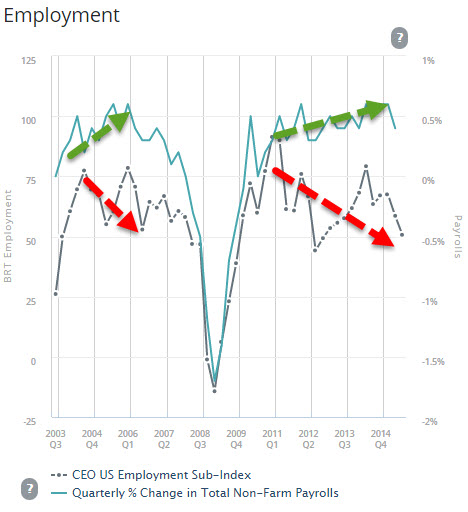

But most worrisome is the disparity between CEO’s employment perspective and the BLS ‘augmented reality’ having never been higher.

If this is the true state of the labor market, then – once again – The Fed will act on The BLS’ delusionally positive ‘adjusted’ data at the worst possible time.

The Business Roundtable

Leave A Comment