THE “STATE OF THE MARKETS”…

Another week, another all-time high. Ho-hum.

Despite the relentless rise in stock prices, the current market environment seems to offer an awful lot for analysts to complain about. There is the lack of volatility, something that hasn’t been seen for decades. There are the valuation levels, which, at the very least, have become extreme (and are worsening). There is the rate of the recent rise, which is starting to look a bit “parabolic” and purportedly tied to the passing of the Trump tax plan. There are concerns about inflation. There are worries about the ability of corporate earnings to continue to deliver. There is the Bitcoin mania. And finally, there are my seemingly constant whining that the indicators aren’t as strong as they “should be.”

However, if there is anything that I’ve learned about the markets over the last 30 years, it is that Ms. Market doesn’t give a hoot about what we “think” should be happening in her game. In addition, it is important to note that moves such as we are seeing now can drive a bear to drink as they tend to last longer than almost anyone can imagine.

Thus, I believe the key to this environment isn’t to try and figure out what is “wrong” with the market (remember, markets are never wrong, but traders often are), but rather to recognize that we have to play the cards we are dealt. In other words, it is what it is and we need to deal with it. So, from my seat, we must keep in mind that the bulls remain in charge of the game but, as I’ve been saying for some time now, this is not a low-risk environment.

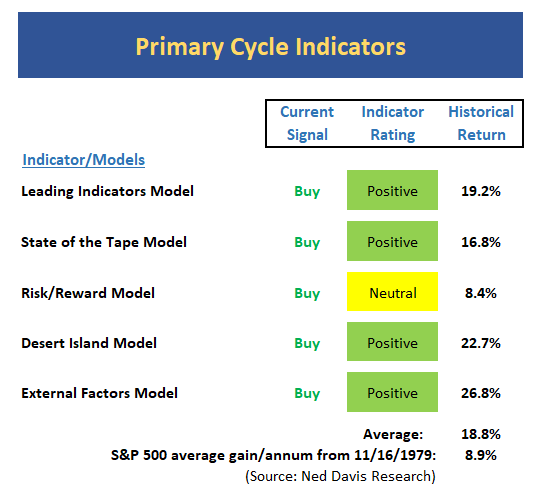

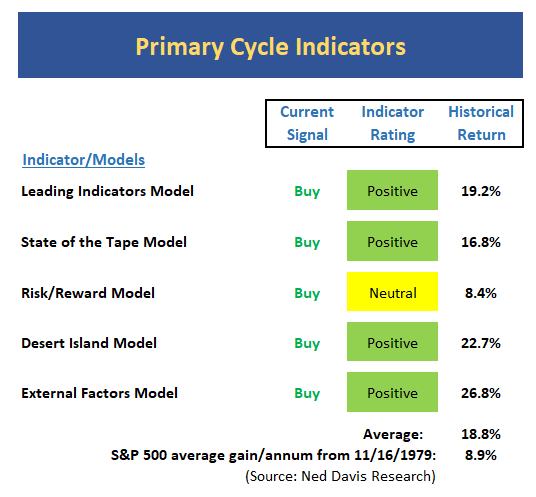

THE STATE OF THE BIG-PICTURE MARKET MODELS

Let’s start with my “executive summary” of the state of the market – I.E. a review my favorite big-picture market models, which are designed to tell us which team is in control of the prevailing major trend.

Executive Summary:

Leave A Comment