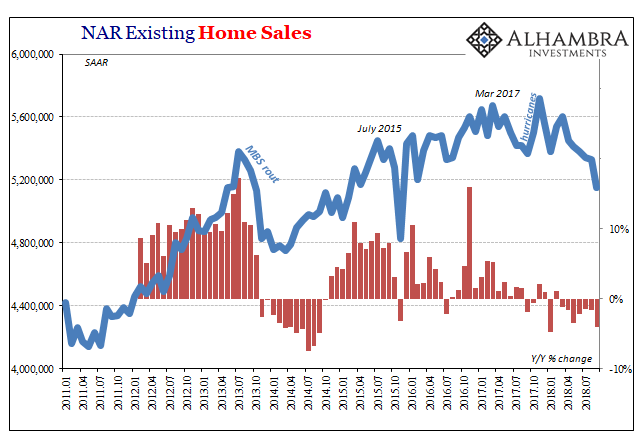

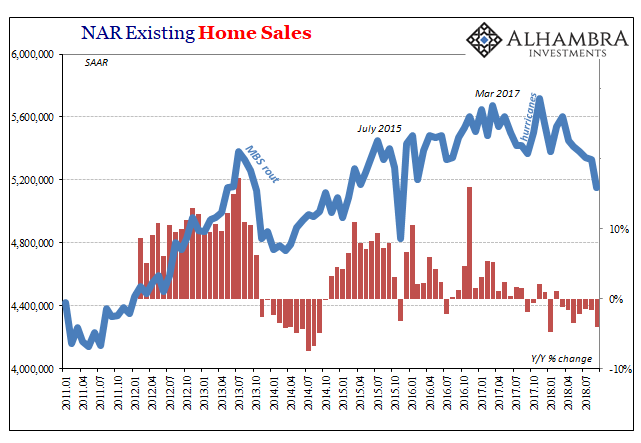

If it wasn’t before, it is definitely a slump now. The National Association of Realtors (NAR) said today that the sales of existing homes across the US in September 2018 fell more than 3% seasonally-adjusted from August. At just 5.15 million (SAAR), that’s the lowest volume in almost three years.

Hurricane Harvey had managed to disrupt a good chunk of resale activity in September 2017, and yet there is only Florence to blame for September 2018 which managed somehow to post significantly fewer home sales. Year-over-year, sales activity dropped by more than 4%.

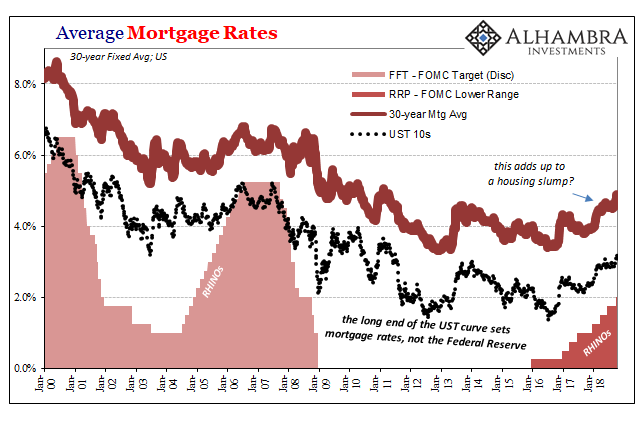

Economists want to make this about interest rates. That’s a big change from late last year when the hurricane high had many convinced that the economy was so much booming not even the Fed could disrupt the real estate sector.

To begin 2018, there was only strong, robust, and the several variations of the theme. Resales had reached an 11-year high which supposedly meant like everything else globally synchronized growth was real and inflation hysteria justified. The consequences of those would have been, had they been legitimate processes, higher mortgage rates regardless. The economy is booming, requiring normalization, and then normalization totally disrupts the boom?

That’s not how this works. Three-quarters through the year, it’s a different story:

A decade’s high mortgage rates are preventing consumers from making quick decisions on home purchases. All the while, affordable home listings remain low, continuing to spur underperforming sales activity across the country.

Mortgage rates follow the 10-year UST benchmark rate. They started the year, on average ~4%. Interest rose to ~4.6% for most of the summer including September. A 60 bps increase off historic lows is time for a sizable housing slump?

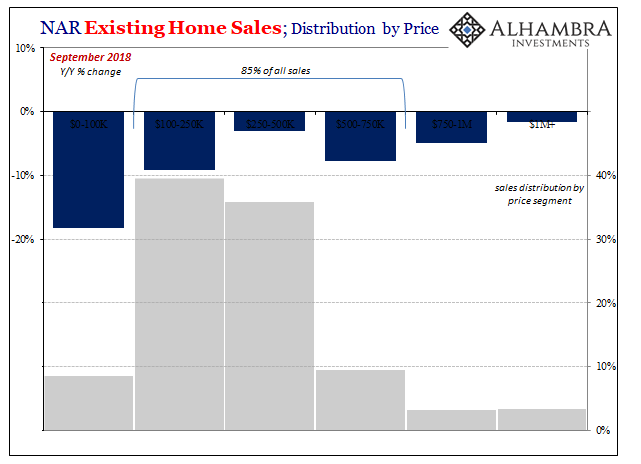

It’s not the chart for mortgage rates that should have gotten realtors attention. Instead, it’s this one from the NAR:

Sales were down across-the-board in September, at all levels. For the past few years, the real estate market had been bifurcated like the economy. Those who were doing well bought high end houses no matter what happened along the way, no matter how much they cost including monthly payment schedules. Those who haven’t been, and in this economy the last eleven years there are way, way too many of these “missing” Americans, they not only stopped buying houses they actually stopped selling what they had been fortunate enough to hold onto.

Leave A Comment