Somewhat surprisingly, the world did not end overnight.

As you’re no doubt acutely aware, the Cboe officially launched Bitcoin futures on Sunday and although more than a few commentators suggested this swan dive into dark, uncharted waters (into which the CME will likewise wade just days from now) could presage the end times, it looks like the sun rose on Monday as usual.

To be sure, there were some minor hiccups. As documented here extensively during the initial drama, the public’s fascination apparently overwhelmed Cboe’s website which crashed almost immediately, sending Twitter into a frenzy. Volume was of course comparably meager, but apparently wasn’t as low as feared.

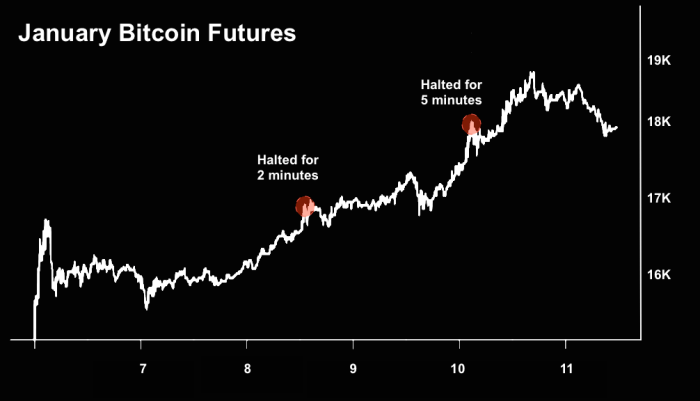

Predictably, circuit breakers were tripped twice (once after we were up 10% and again after 20%, in accordance with the rules):

“So far, looking at the contract volume traded, we believe that there is a decent demand and this is driving up the price of bitcoin,” TF Global Markets Naeem Aslam told Bloomberg, which adds that the notional value traded during the first eight hours of futures trading was around $41 million, a pittance compared to the more than $1 billion of Bitcoin that was traded against the dollar over the same time frame.

Here’s where Bitcoin itself is trading across exchanges (futures launch highlighted in yellow):

“Our approach is to start small and see how it goes and be cautious. I think that’s the way everyone is approaching it,” said Garrett See, chief executive of DV Chain, who spoke to FT.

Meanwhile, the masters of the monetary universe are not amused. “Futures merely mean that you can bet on a product,” the ECB’s Ewald Nowotny told reporters today in Vienna. “One has to note that bitcoin is not a currency. It doesn’t fulfill the criteria. It’s a speculative product,” he added, before essentially making a threat: “Based on its scope, one should probably discuss whether regulatory steps are necessary here.”

Leave A Comment