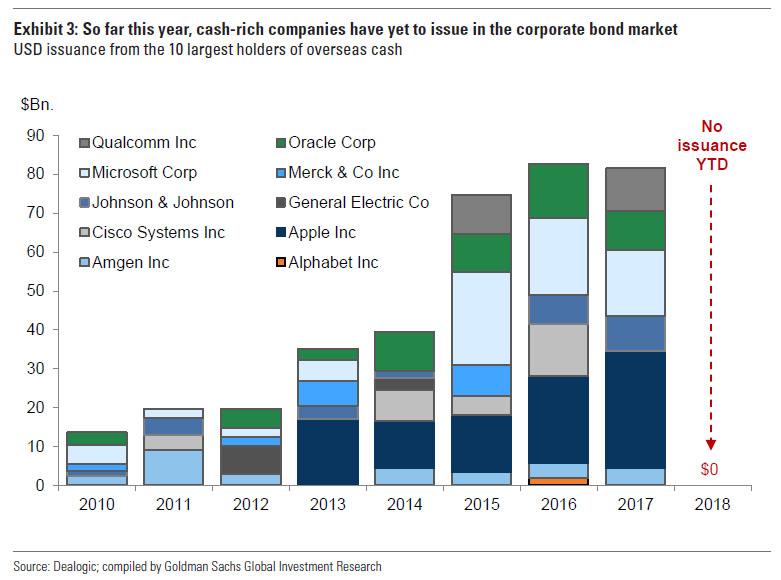

At a time when Trump’s tax repatriation holiday allowed many corporations to avoid issuing debt altogether, leading to what some have dubbed corporate quantitative tightening, and resulting in many cash-rich corporations to not issue any debt in 2018…

… some bond traders have lamented the lack of high-grade supply. Today that changes because Cigna is selling $20 billion of bonds to fund its takeover of Express Scripts, in what will be the U.S. corporate-bond market’s second-biggest of the year.

According to Bloomberg, the health insurer is selling senior unsecured bonds in 10 parts: the longest portion of the offering, a $3 billion security maturing in 2048, is expected to yield 1.87% points above Treasuries, a sharp tightening to initial price talk which was initially at around 2.05% points.

The sale is leading what’s been a busy start to September, with some strategists already raising their monthly issuance estimates. Investors, anticipating that a bulging pipeline of M&A deals would bring a wave of debt sales after the summer lull, have been selling debt the past few weeks to make room for new securities, said Travis King, head of investment-grade credit at Voya Investment Management in Atlanta.

“It’s the kind of deal where everyone is going to feel that they need to own this,” King said. “It’s one of those classic mega deals that gets everyone’s attention”.

Surprisingly, or perhaps not in light of today’s tech rout, treasury yields failed to drift wider due to rate locks, the expected boost in new-issue supply has boosted the amount of yield investors demand to hold corporates over govvies, and as a result, investment-grade bond spreads over Treasuries widened by a material 6 bps since the end of July to 115 basis points.

The mega deal, like most other recent blockbuster bond sales, is for M&A: in March, Cigna agreed to buy Express Scripts for $54 billion in an attempt to save money for clients by bringing two branches of the health-care services sector under one roof.

Leave A Comment