More geopolitical turmoil is probably not what the doctor ordered for markets on a day when Trump’s decision on the Iran deal is on deck, but you know what they say about “when it rains”.

As Barclays recently noted, the geopolitical environment “is littered with a historically large number – by one measure, the highest since World War II – of international conflicts with high potential to affect the global economy and markets.” And while Italy’s hopelessly fraught political situation doesn’t really qualify as an “international conflict”, it most assuredly qualifies as “conflicted” after an inconclusive election in March left the country without a government.

Of course, thanks in part to ECB QE, having a government apparently isn’t a prerequisite for finding sponsorship for your debt. In fact, as of early April, periphery debt had become an “unlikely” safe haven at a time when the world was teetering on the edge of a trade war.

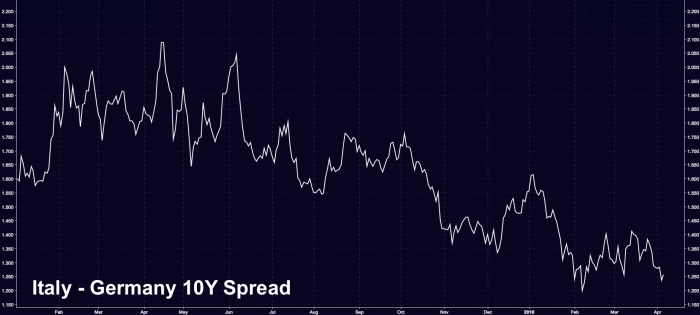

Here’s what the yield spread between the safest of safe havens (bunds) and Italian 10s looked like as of April 5 (note the steady grind tighter):

Of course, as we reminded you at the time, BTPs have gotten more than a little support from a certain central banker who has pledged to everywhere and always do “whatever it takes” to make sure the periphery doesn’t lose market access like it nearly did during the European sovereign debt crisis.

Well fast forward a month and now it looks like new elections are coming in Italy. As Bloomberg writes, “Luigi Di Maio, head of the anti-establishment Five Star Movement, and Matteo Salvini, who leads a center-right alliance and the anti-immigrant League, are pressing for an election in July after efforts to form a government broke down [and] the populist rivals met in Rome Monday for the first time in since the March election following weeks of phone contacts.”

Leave A Comment