The prices of the metals were sagging. Silver was trading around $13.80.

On Wednesday, Janet “Good News” Yellen said the magic words. The Federal Reserve hiked the federal funds rate by 25 basis points. The price of silver was surging in anticipation of the news (we assume). Within an hour or so of the announcement, it had spiked to $14.32, up 3.8% in a few hours.

Despite our note on 8 November, this week we have seen more than one article claiming that a rising interest rate is good for gold. Take a look at any longer-term chart of interest and the price of gold. They aren’t highly correlated.

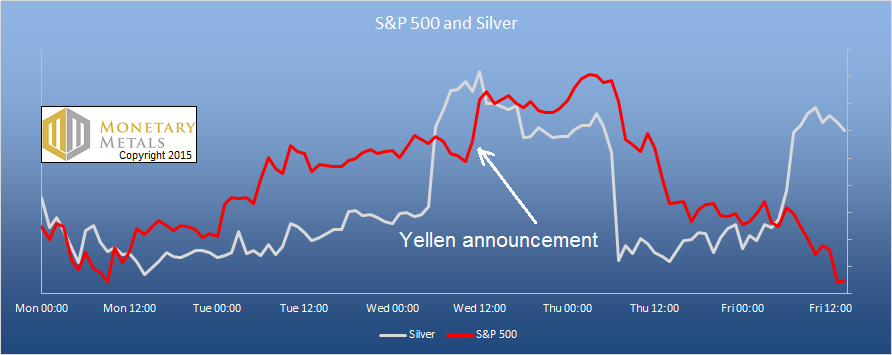

Today, let’s look at a chart of the price of the S&P 500 overlaid with silver, zoomed in to this week. We’ve labeled the Yellen announcement.

The Prices of Stocks and Silver

Stocks did a round trip up and down. Silver did the same thing, but then diverged. Is this it? Is this finally the move to rocket hire that many have been over confidently predicting?

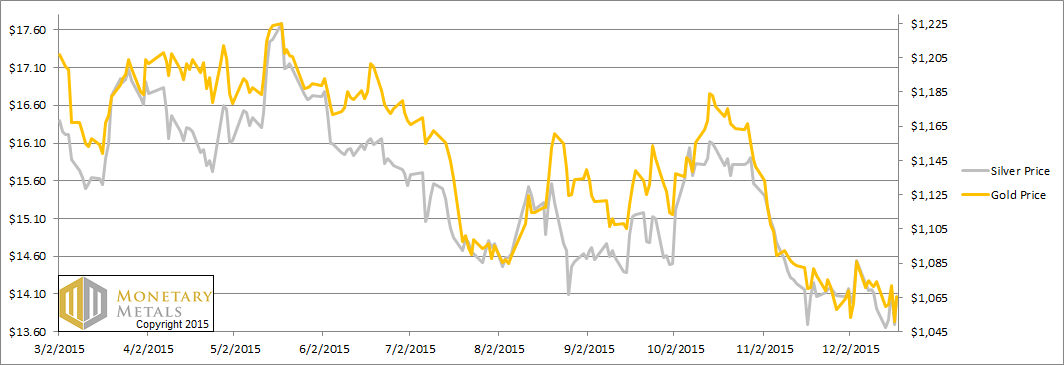

Read on for the only true look at the fundamentals of gold and silver. But first, here’s the graph of the metals’ prices.

The Prices of Gold and Silver

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production (stocks to flows) can be measured in months. The world just does not keep much inventory in wheat or oil.

Leave A Comment