Back in February, around the time Bloomberg caught up to what we had been discussing for the past year, namely the historic dumping of US Treasurys by offshore official investors (such as central banks and reserve managers, just as the selling had in fact reversed and foreigners had resumed buying once more) we noticed that it was not China but Japan that had emerged as one of the most aggressive sellers of Treasuries following material Mark-to-Market losses on existing TSY holdings, prompting the foremost ex-Fed shadow banking expert Zoltan Poszar to declare the selling “a deer in the headlights moment”.

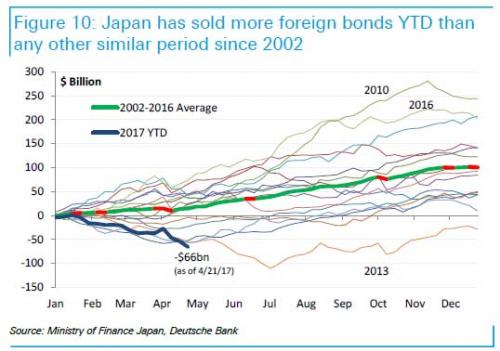

Fast forward two months, when according to the latest update from Deutsche Bank, Japan’s revulsion to fixed income products has accelerated, and the Pacific island was a net seller of foreign bonds again in the past week, divesting another $12bn worth of securities. It was not only the third straight week of selling out of Japan, according to MOF data, but more remarkably, the year-to-date divestment of $66bn in foreign bonds is the biggest since 2002, the first full year of such data is available.

What is prompting the sudden liquidation? According to Deustche, “profit-taking most likely explains Japan’s selling.”

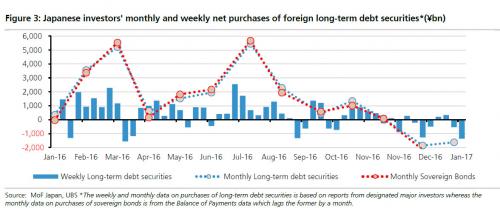

Ten-year Treasury yields declined in April to a lower level than any previous month since the Trump election. In the process, yen cross-currency basis has tightened to levels not seen since January 2016. Japanese investors use the yen basis (or more precisely, their derivative FX forwards) to hedge the currency risk of their coupon flows from non-yen bonds. The basis tightens when there is a drop in demand to swap yen for dollar.

The next chart, which shows the distinctive inverse relationship between cumulative Japanese purchases of foreign bonds and the 3m yen basis, should be useful to anyone still confused by what has been the biggest driver behind the gradual drop and sudden recent spike in the USD-JPY currency basis: it all has to do with Japanese TSY demand, and hedging costs (which we pointed out had risen so high last August it made TSYs and JGBs look equally priced to Japanese investors).

Leave A Comment