In the last days of 2017, we showed something surprising: as a result of suddenly exploding USD/JPY funding costs, there had never been a worse time for Japanese investors, traditionally some of the most ravenous purchasers of US paper, to buy US Treasurys.

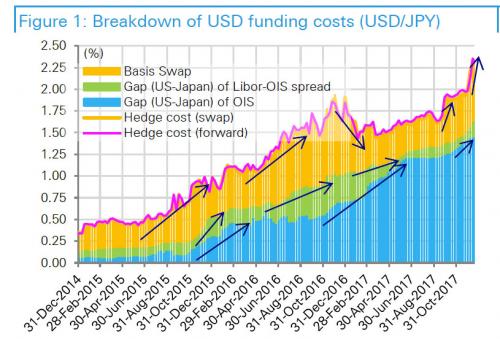

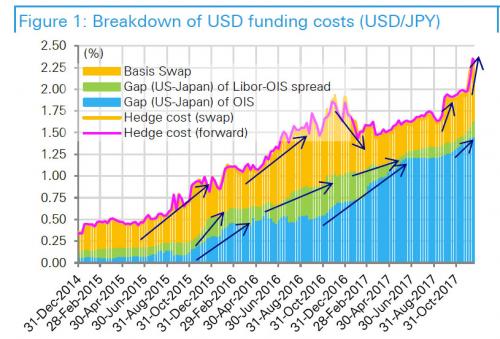

As we explained on December 27, USD funding costs for Japanese insurers and banks to invest in US Treasuries – which had surged reaching a post-financial-crisis high of 2.35% on 15 Dec – are determined by three things, namely (1) the difference in US and Japanese risk-free rates (OIS), (2) the difference in US and Japanese interbank risk premiums (Libor-OIS), and (3) basis swaps, which illustrate the imbalance in currency-hedged US and Japanese investments.

In this particular case, widening of (1) as a result of Fed rate hikes and tightening of dollar funding conditions inside the US (2) and outside the US (3) have occurred simultaneously. This is shown in the chart below.

Whatever the cause behind these sharp funding shortages, one thing was clear – dollar funding costs (FX hedging costs) for both Japanese insurers, banks and other investors to buy US Treasuries were surging (with Japanese buyers and reached a post-financial-crisis high of 2.35% on 15 Dec. And in terms of practical implications for the treasury market this means that, all else equal, marginal demand for US paper is about to plunge for one simple reason: the FX-hedged yields on US Treasurys have plunged to (negative) levels never seen before (unless of course foreign investors buy US Treasurys unhedged).

To demonstrate this point, the chart below from Deutsche Bank shows the yields on currency-hedged US Treasuries from the perspective of Japanese investors. Annualized hedge costs had risen to 2.33% at the end of December, which means that investments in 10y US Treasuries would result in virtually no yield. Furthermore, yields from investment in shorter than 10y US Treasuries would be less than JGBs and result in negative spreads.

Leave A Comment