Ever since the Federal Reserve first got into the business of blowing massive equity bubbles back in the 1980’s, Americans have shown a willingness to happily, if ignorantly, embrace each successive iteration to the rigged market. Of course, as E-Trade recently confirmed via the following ad, making money in equities is a very simple two-step process: (1) get invested, (2) buy a yacht made of Cuban mahogany and party with models…why would anyone in their right mind pass that up?

Unfortunately, at least for the central planners at the Bank of Japan who would love to be as efficient at creating asset bubbles as their U.S. counterparts, Japanese investors have a slightly longer memory than U.S. investors and have shunned stocks ever since an entire generation of wealth was wiped out in the 90’s. After 20 years of stocks pretty much only trading in one direction, one can understand their concern.

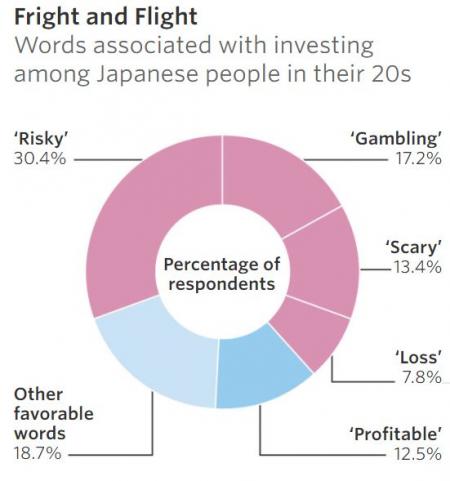

Moreover, given the chart above, perhaps it’s not surprising that millennials in Japan use the words “Risky”, “Gambling”, “Scary” and “Loss” most frequently to describe the idea of “investing” (chart per the Wall Street Journal).

All that said, as the Wall Street Journal points out today, with an aging population and trillions of dollars worth of pension promises about to come due, Japan’s central planners have no option to double down on efforts to convince millennial investors to once again throw all of their money into the Nikkei slot machine.

If anything can persuade Japanese to invest, it may be fear rather than greed. The government’s debt, more than twice the nation’s annual output, has fanned doubts about whether promised pensions will be forthcoming decades from now.

More than half of Japan’s household wealth sits in bank deposits or cash under the mattress, according to the Bank of Japan, compared with 14% in the U.S.

“We have to increase our assets. Otherwise we cannot survive in a super-aged society,” said Satoshi Nojiri, director of the Fidelity Retirement Institute in Japan.

Leave A Comment