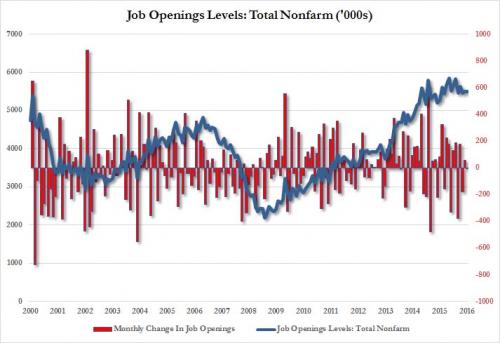

While too backward looking to be actionable (it reflects the labor situation with a 2 month delay) especially in a time when everyone is focused on the future of Trump’s fiscal policies (whose details have still to be revealed), today’s JOLTs report showed few changes for “Janet Yellen’s favorite labor market indicator”: the number of job openings was little changed at 5.501 million, down from downward revised 5.505 million, missing expectations for a second consecutive month: consensus was looking for 5.568 million jobs. The job openings rates as a % of total employment declined to 3.6% from 3.7%, but will hardly be noticed in a labor force which the Fed already deems to be near full employment.

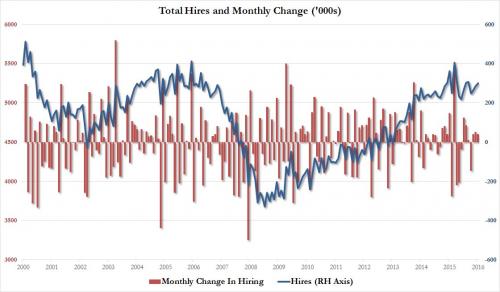

Hires and separations were also little changed at 5.252 million (up from 5.212 million), and 4.968 million (down from 5.018 million), respectively. However, as we have observed before, the pace of hiring appears to have tapered off, after hitting cycle highs in February 2016 at 5.5 million, and remaining at levels largely unchanged over the past 2 years.

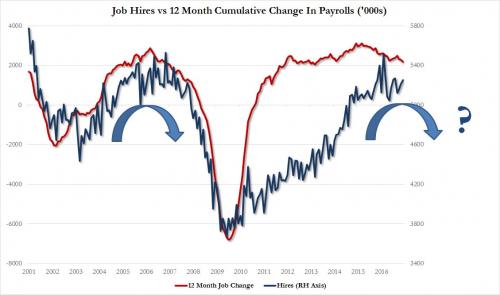

As shown in the next chart, while the trailing pace of job additions has been modestly declining in the past two years, net hiring also appears to have plateaued.

A potentially concerning trend emerges when looking at the “quits” rate, or the so-called take this job and shove it indicator, which rumbled by 98,000, or the most since last February,to 2.979 million, the lowest print since July, suggesting that Americans may have gotten more worried about quitting their job for various economic or personal reasons.

Meanwhile, discharges and other layoffs jumped by 16,000 in December rising to 1.635 million, the third consecutive monthly increase, after hitting cycle lows of 1.513 million in September, as employers appear to be finally accelerating terminations of workers.

Leave A Comment