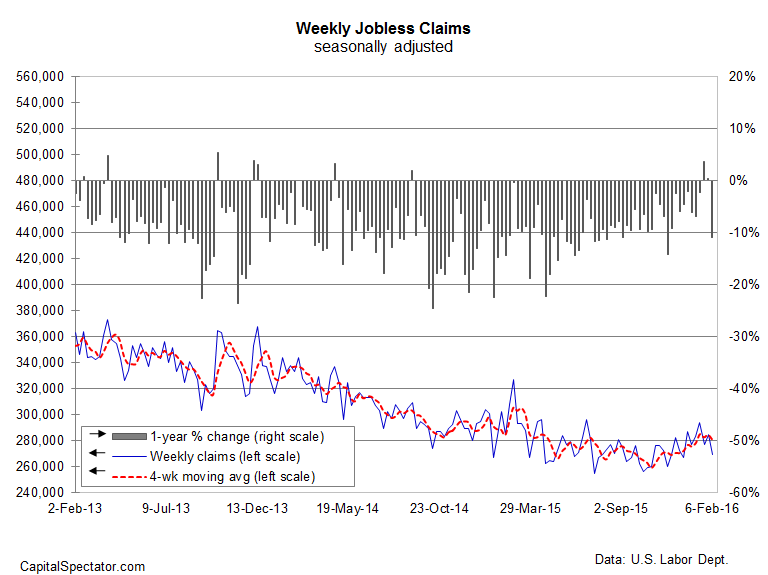

New filings for unemployment benefits fell 16,000 last week to a seasonally adjusted 269,000, according to this morning’s weekly report from the US Labor Department. The slide represents a timely challenge to the dark outlook that’s currently reflected in a markets-based forecast for the US economy. In other words, there’s enough ambiguity to keep the crowd guessing, which means that the days ahead could be decisive for deciding which side of the debate about the business cycle is accurate. But for today, at least, there’s a new number in town for the macro profile and it offers an upbeat data point to consider.

A bit of good news in today’s claims data is especially notable because the update reverses the bearish aura that’s been bubbling in this data set lately. Indeed, in each of the previous two weeks new filings increased in year-over-year terms—the first back-to-back annual gains in over a year. A third week of red ink would have been worrisome for this leading indicator. But today’s update effectively dodges that bullet. In fact, the latest release tells us that claims fell a hefty 10.9% for the previous week vs. the year-earlier level—the biggest annual slide since last November.

Today’s claims report advises that it’s still premature to make a high-confidence call that the US has slipped into an NBER-defined recession. Tomorrow’s monthly update on retail spending for January will offer another stress test for deciding if the markets-based outlook of trouble is overbaked.

Yes, there’s a mea culpa due in one corner or the other, but until we see more data it’s all a guessing game about what happens next.

Meantime, the near-term projections for The Capital Spectator’s Economic Trend & Momentum indexes imply that the economic recovery will survive (based on this morning’s update of The US Business Cycle Risk Report), albeit in moderately diminished form. But the volatile state of markets is telling us that the outlook could change, perhaps quickly, and so close monitoring of the incoming data remains crucial.

Leave A Comment