Online lenders have an issue (especially the publicly traded ones, like OnDeck Capital (ONDK) and Lending Club (LC)). They may have come from nowhere over the past couple of years to be presently underwriting billions of dollars of loans a year. But this growth comes at a price, as borrower acquisition is proving to be quite expensive.

A recent WSJ article described how the marketplace lenders (in this case, Lending Club and Prosper) are resorting to old-school direct marketing techniques, sending millions of monthly offers via the postal service, to feed their appetite for loan acquisition. Efi Pylarinou conducted an interesting analysis this week that demonstrated that for the short term, at least, customer acquisition costs (CAC) for the online lenders should outstrip their margins.

Partnerships between bank and online lender are win-win

So, to grow profitably, the publicly traded online lenders (private ones aren’t subject to this level of transparency) must find a more efficient way to onboard new borrowers at scale. One immediate way to do this is via partnerships. Large institutions who own the relationships with individuals (personal loans) or SMBs (business loans) but are not yet in the online lending space are looking to make build/buy decisions right now. In rolling out their own online lending offerings, these incumbent financial institutions have to build their own platforms or partner with existing online lenders and leverage their technology platforms.

Partnerships like these have the potential to significantly benefit both incumbent and startup. A partnership enables a large bank to launch quicker, leveraging the operations and technologies of a partner. The younger online lender brings its technology to the party and gets a partner who is going to take care of borrower acquisition — the partner already owns the relationships.

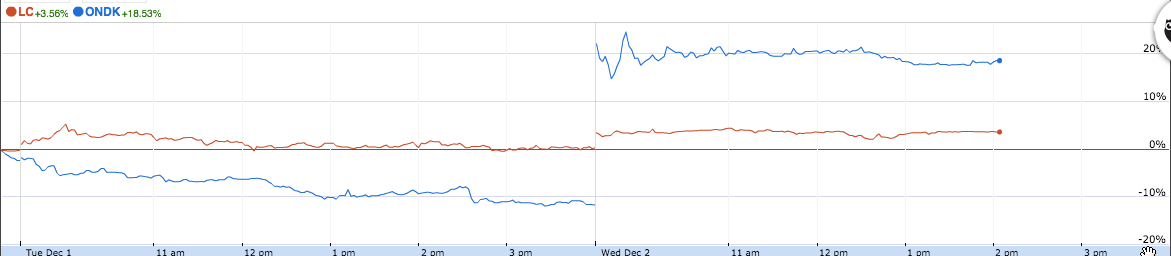

OnDeck stock jumps on JPMorgan partnership

Leave A Comment