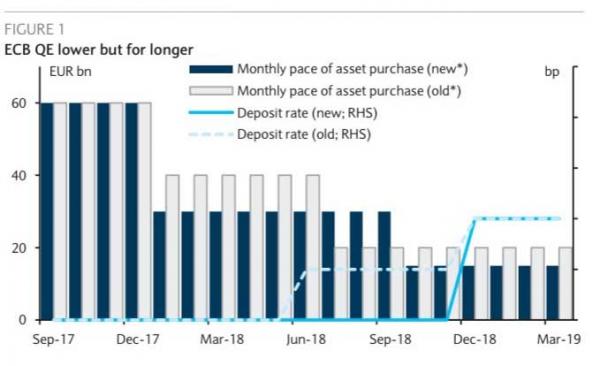

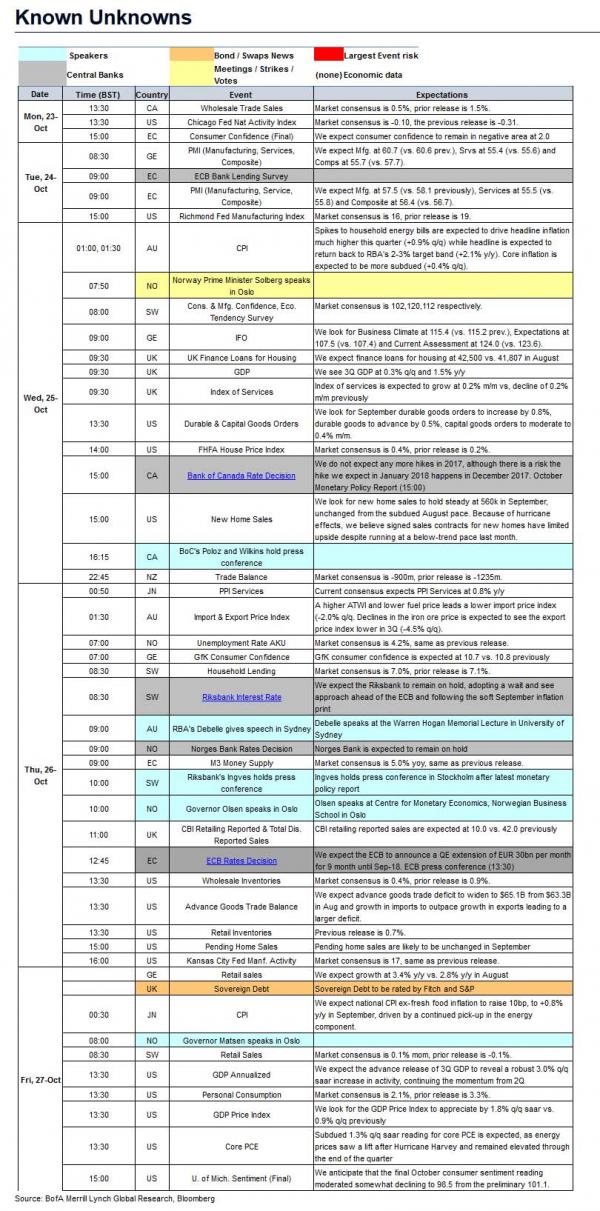

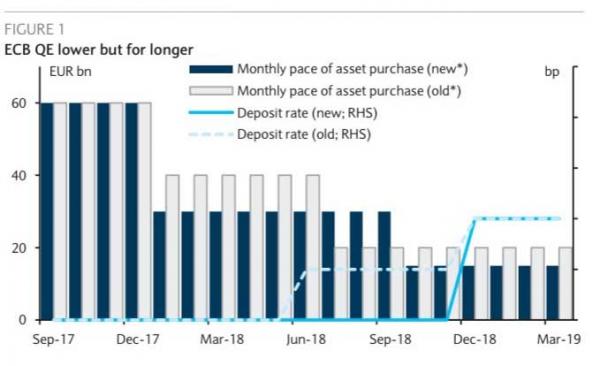

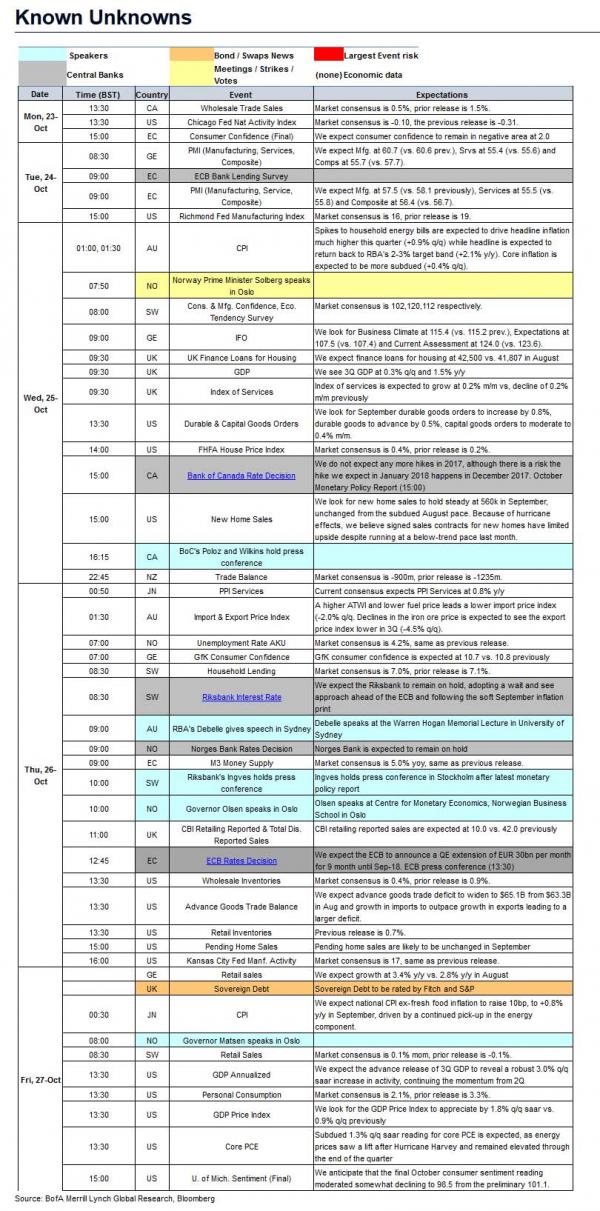

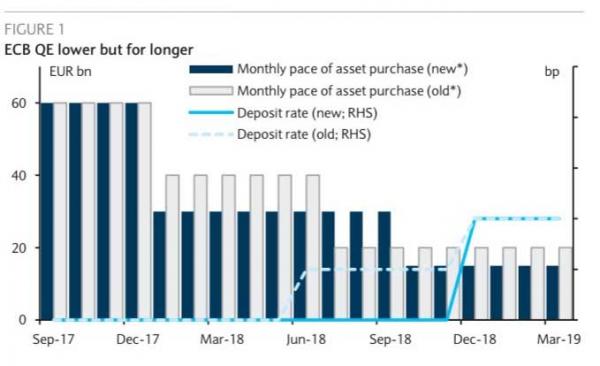

The main event this week will be the ECB’s taper announcement on Thursday where consensus expects the ECB to announce a QE extension of €30bn per month for 9 months until Sep-18, with potential extensions thereafter. Net purchases between now and Dec-17 will continue at €60bn per month as planned. To cope with rate hike expectations, the ECB is also expected to strengthen forward guidance.

In Canada, the BoC is no longer expected to hike rate this Wednedsay, instead, it will likely have a gradual hiking cycle in 2018 with three 25bp hikes in Jan, Apr, and Jul, according to BofA. Both the Riksbank and the Norges Bank are likely to remain on hold adopting a wait and see approach ahead of the ECB. Monetary policy meetings will be held in Russia, Brazil, Turkey, Hungary, Colombia and Ukraine. We forecast Russia’s CBR to cut 25bp and Brazil’s BCB to cut 75bp.

Among this week’s economic reports, we get Euro area mfg, srvs and comps PMI, which are expected to decrease slightly (57.5/58.1, 55.5/55.8, 56.4/56.7, Tue) and UK GDP qoq to decrease to 0.2% from 0.3% (Wed). In US, the advance release of 3Q GDP is expected to rise to a robust 3.0% qoq saar increase in activity, with the GDP Price Index appreciating by 1.8% qoq saar and a more subdued 1.3% qoq saar reading for core PCE (Fri). In Japan, national CPI ex-fresh food inflation is likely to raise 10bp, to +0.8% y/y, driven by a continued pick-up in the energy component (Fri).

In summary:

In the US, durable & capital goods orders, new & pending home sales, GDP, core PCE and final print of U. of Michigan sentiment are released.

In the Eurozone, we wait for central bank rates meeting, final print of consumer confidence, PMIs, money supply M3 and ECB bank lending survey.

In the UK, key releases include GDP and index of services.

In Japan, we have PMI Manufacturing, PPI services and CPI.

In Canada, central bank rates decision is main event.

In Australia, we have CPI, PPI and import & export price index.

In New Zealand, only trade balance is coming up.

In the Scandies, we have Norges Bank and Riksbank rates meeting. In Norway, we also have unemployment rate and Sovereign Wealth Fund 3Q results, while for Sweden we get PPI, trade balance, retail sales, consumer & manufacturing confidence.

In Switzerland, we have sight deposits and money supply M3.

A breakdown of key events by day courtesy of Deutsche Bank:

Monday: A fairly light start to the week for data with mostly second tier releases including China property prices data for September, Eurozone consumer confidence for October and UK CBI business optimism and total orders data for October. Perhaps the most significant event will be a likely statement from UK PM Theresa May to Parliament on the progress of Brexit talks following the EU summit.

Tuesday: The big highlight datawise will be the October flash PMIs due in Japan, France, Germany, Euro area and US. French confidence indicators for October and the Richmond Fed PMI in the US for October are also due. The ECB Bank Lending Survey will also be worth watching while in the UK Chancellor Hammond is scheduled to face questions in the House of Commons. The Bundestag convenes for its inaugural session following the election while in China the CPC wraps up with the appointment of the Central Committee. AT&T, General Motors, Novartis and McDonalds all report earnings.

Wednesday: A fairly busy day for data. In the morning the German IFO survey for October and advance reading of Q3 GDP for the UK are due. In the US the flash durable and capital goods orders data for September are due, along with September new home sales and the August FHFA house price index. Brexit will be under the spotlight again with Brexit Secretary David Davis due to testify before lawmakers. Coca-Cola, Boeing and Lloyds are among the companies due to release earnings.

Thursday: No doubting the highlight with the ECB meeting at 12.45pm BST and Draghi press conference shortly after likely to be front and centre. Data wise we’ll receive German consumer confidence for November, Euro area M3 money supply for September and UK CBI retailing reporting sales for October prior to the ECB. In the afternoon across the pond wholesale inventories for September, initial jobless claims, September advance goods trade balance, September pending home sales and October Kansas City Fed manufacturing activity data are all due. Barclays, Twitter, Amazon and Alphabet are amongst those due to report results.

Friday: The early focus overnight will be the September CPI report in Japan, while September industrial profits data in China is also due. In France consumer confidence data in October is due while in the US the highlight will be the first estimate of Q3 GDP in the US. The final University of Michigan consumer sentiment survey for October is also due. The ECB’s Praet and Nowotny are also both scheduled to speak. UBS, Exxon Mobil, Chevron and Total all report results. Deutsche

Leave A Comment