King Dollar weakness over the past 18-months has been of benefit to several commodities. Are the good times for commodities about to end due to a U.S. Dollar rally? Are inflation concerns peaking as the Dollar is testing support? Possible!

Below looks at King Dollar over the past 25-years

The U.S. Dollar has spent the majority of the past decade inside of rising channel (1). The weakness that started around a year ago has it testing parallel rising support and a few other potential support lines at (2), while momentum is now the lowest since 2008.

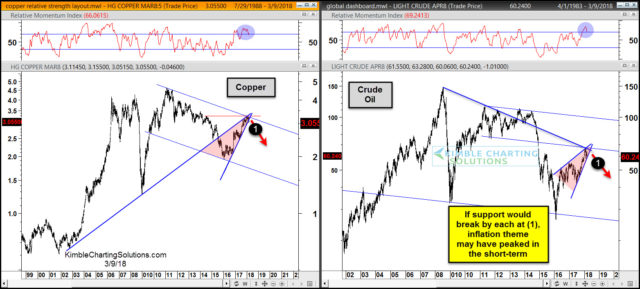

Below looks at Crude Oil and Copper and how each is testing key support tests-

Copper & Crude have experienced long-term counter-trend rallies the past couple of years. These rallies have both of them testing the top of falling channels at the apex of potential bearish rising wedges as momentum is lofty and could be starting to roll over.

Joe Friday Just The Facts Ma’am- If King Dollar rallies off the cluster of support, Copper and Crude Oil could break support at each (1). If these events take place, it would suggest that inflation concerns could back off for a little while.

Leave A Comment