You’re in a big winning crypto trade. Your open profits continue to increase every day. Congratulations! But do you know exactly why and when to exit winning trades, before the smart money help themselves to some, or even all, of your hard-won gains?

This article will demonstrate several prime, low-risk profit-taking setups that can help you predetermine your trade exits before it becomes obvious to the herd. By exiting ahead of the crowd, you’ll be able to retain far more of your open gains. You’ll also experience less stress and spend less time in the market, thus reducing your risk exposure.

Strategy #1: Using Price Cycle Bar-Counts in Conjunction with Support/Resistance and Price/Momentum Divergences (Long Trades)

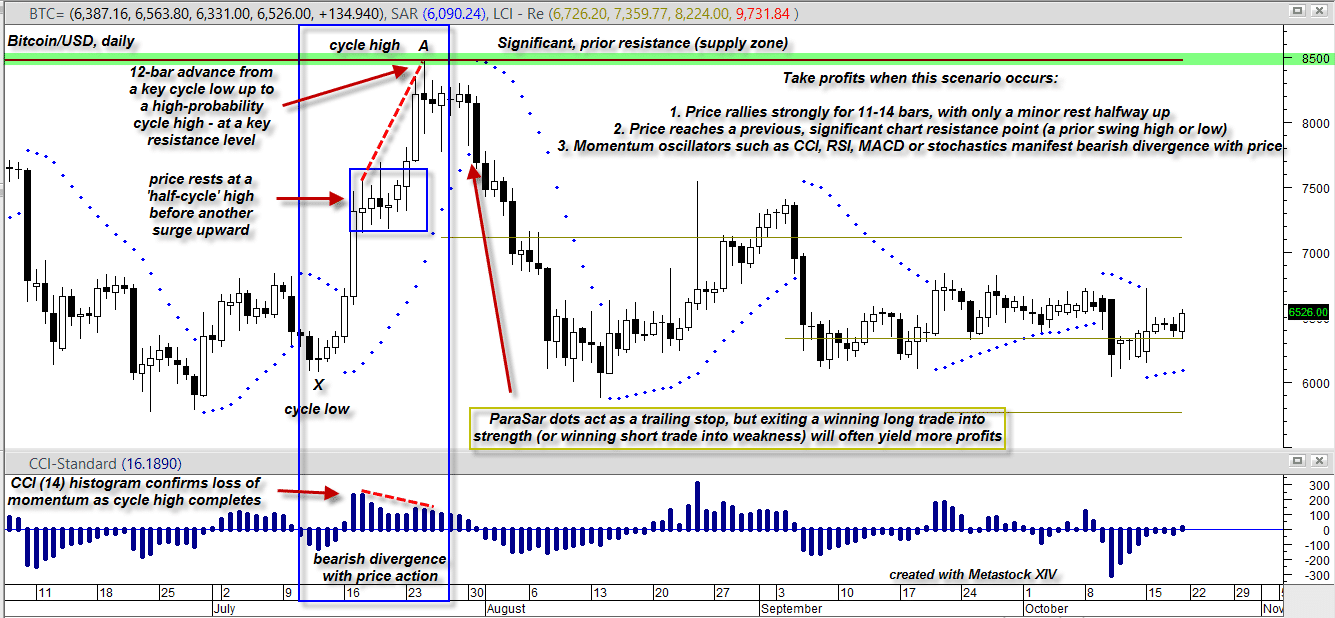

Most liquid (high trading volume) crypto markets run on a 16-24 bar price cycle (measured from trough to trough, the average usually being 18-20 bars). By plotting a double stochastic oscillator on your charts, you can visually anticipate where the next tradable cycle low may appear. This accurate technical indicator can give you added confidence in entering/exiting your trades. In the trade example below, I’ve identified a valid cycle low at X in BTCUSD’s daily chart. Price accelerates higher in the next four bars, consolidates for several more, and then makes a final surge up to point A. There are several cycle dynamics at work here that you need to internalize:

Figure 1.) Bitcoin/USD, daily. Using a knowledge of cycle bar counts and other technical indicators can alert you to prime profit-taking exits – before the rest of the crowd. Chart graphic: Metastock.com

After a strong 11-14 bar rally (one with no discernible reversals along the way), the probability of further gains is extremely low. So, once price accelerates higher out of the first stall zone, begin to scale-out of at least a third of your open gains once bar 10 is reached, take the next third off by bar 11, and by all means be completely out of the trade and into cash before price runs smack into a major resistance line.

Leave A Comment