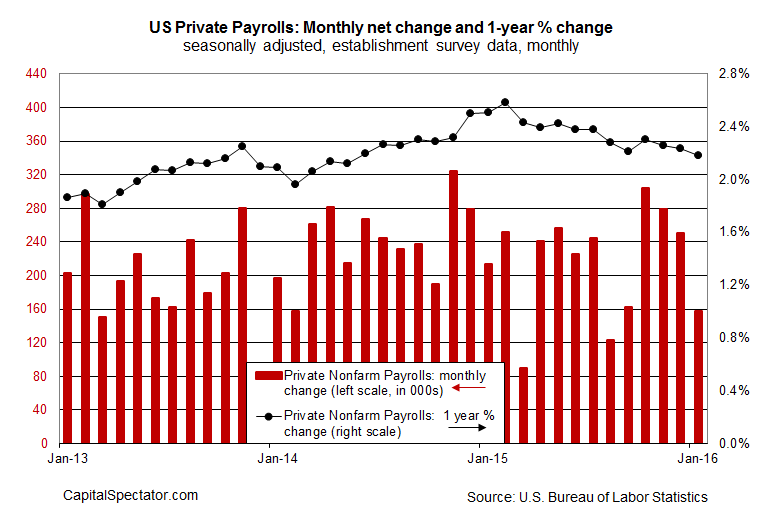

US companies added substantially fewer jobs last month than analysts expected, according to this morning’s update from the Labor Dept. The 158,000 increase in private payrolls is a decent gain, but it’s well below Econoday.com’s consensus forecast for a 180,000 pop. Meantime, the slow grind lower for the year-over-year gain rolls on, echoing yesterday’s numbers from ADP. The labor market still has a fair amount of forward momentum, but the evidence is building that the peak has passed. That’s a concern at a time when the broad trend for growth has hit some turbulence.

The good news: using the latest data point as a guide still reflects a solid gain for private payrolls via the annual change. The 2.18% increase in January is a healthy advance in context with the historical record over the past two decades. The worry is that the persistent and ongoing deceleration in the trend that’s been in play for the past year is a signal that the recovery’s internal momentum may be fading.

To be fair, a similar downshift unfolded during the 12 months through the first quarter of 2013. It turned out to be a false alarm, although the real-time numbers suggested otherwise until well after the fact. For perspective, that downshift cut the year-over-year increase in private payrolls to roughly 1.8% as of March 2013–down from the previous peak of nearly 2.5% a year earlier.

By that standard, the current 2.2% year-over-year increase through last month still looks encouraging. The question is whether there’s more deceleration to come? Today’s update offers a slightly stronger case for answering “yes”. The current 2.2% annual increase is only moderately below the previous peak of 2.6% from a year ago, but gravity appears to be in control, albeit modestly so.

But this debate is far from over. In fact, there’s good news to consider via today’s upwardly revised outlook for GDP in this year’s first quarter: +2.2% via the Atlanta Fed’s GDPNow Model (as of Feb. 5), a strong rebound from Q4’s tepid 0.7% rise.

Leave A Comment