It has been another volatile, illiquid, whipsawed session, driven by the only two things that have mattered so far in 2016, China and oil…. and stop-hunting algos of course.

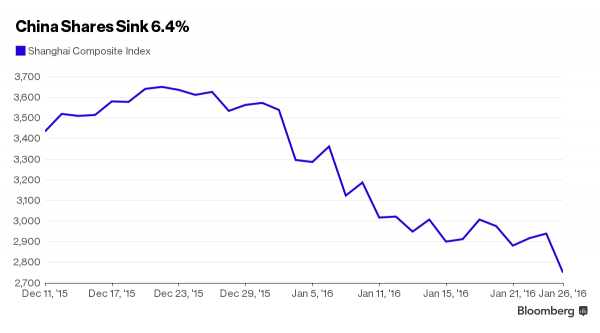

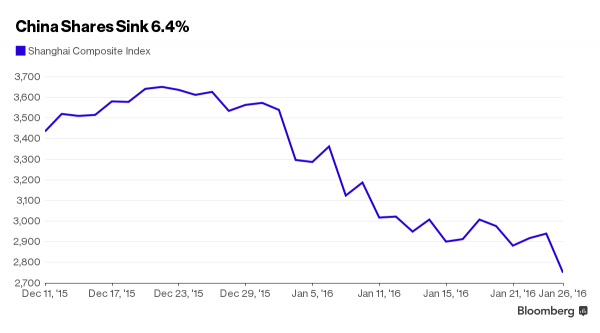

A quick look at the former first reveals that after sliding gradually all session, Chinese stocks puked in the last hour of trading with the China’s Shanghai Composite Index plunging 6.4% to 2,750, the most since the first week of January, and falling to the lowest level since December 2014. The composite has now plunged 22% in 2016 alone and is the world’s worst-performing primary equity index this year.

Among the reasons for the crash was concern about a possible cash squeeze before next month’s Chinese new year holiday as well as further capital outflows amid signs of a slowing economy, Huang Cendong, Shanghai-based analyst at Sinolink Securities, was quoted by Bloomberg as saying. We find that hard to believe, as neither are news.

What is far more accurate is what Wu Kan, a fund manager at JK Life Insurance Co. in Shanghai, said namely that “we are less than two weeks from the spring festival and it seems that most investors have no mood for trading any more.” Indeed, it appears that even the Chinese banana stand traders are tired of participating in a rigged casino and would much rather lose their money on other wholesome activities.

Furthermore, judging by the variety of predictions about what happens to Chinese stocks, such as these:

… it is quite clear that nobody has any idea what is going on in China, or what is coming.

One thing that is certain, however, is that the Chinese government will continue intervening if not in stocks then in FX which it did earlier today in the offshore Yuan which had dropped 0.2% against the USD only to see the entire loss recovered after the PBOC intervened via “large-sized Chinese banks.”

The latest Chinese crash, and continued oversupply fears initially sent crude falling below $30 a barrel. The two-day drop in West Texas Intermediate topped 8% after a 21 percent rally on Thursday and Friday, the biggest in over seven years demonstrating just what a volatile pennystock oil has become. Data on Wednesday may show U.S. supplies rose by four million barrels last week, keeping inventories more than 120 million barrels above the 5-year seasonal average. As a reminder, the sliding price of oil hasn’t deterred Saudi Arabia. It won’t reduce its spending on energy projects, the catalyst for yesterday’s bounce.

And then, as if on cue, WTI and Brent both surged back over $30 after a few flashing read headlines carried the latest statement from the Iraq oil minister Adel Abdul Mahdi who told reporters in Kuwait City that Saudi Arabia and Russia are more flexible now on making cuts and cooperating, and that Iraq is ready to cut if others do so. The only problem is that Saudi Arabia has made it very clear it won’t cut until either the marginal producers cut first, or it puts the marginal shale producers out of business.

Furthermore, it will only take algos a few hours to realize that such statements are merely an opportunity for the oil ministers to sell into especially after Angola nnounced it would boost crude exports to 55.8MM B/D in March, and will ship 58 cargoes, equating to 1.8m b/d, according to final loading program obtained by Bloomberg. This is up from 1.69m b/d in Feb., and 1.77m b/d in preliminary plan for March. In other words, the supply glut is not only not improving, but getting worse by the day.

And then this:

For now however that is irrelevant, as algos saw the Iraqi headlines and ran with them, sending oil rebounding sharply from the lows and back into the green for the day, in the process pushing both US equities, which had tumbled more than 1% earlier, back to unchanged, while the US 10 Year which had tumbled as much as 1.94% overnight is back to just under 2.00%.

At last check, this is where we stood:

Going quickly through the regional markets, Asian stocks traded in firm negative territory following the lacklustre close on Wall St., with sentiment dampened after crude pulled back from its largest 2-day gain in 7 years. Nikkei 225 (-2.4%) was pressured by the oil slump, while telecoms led declines amid losses from index heavyweight Softbank, which continued to suffer from Sprint woes. Elsewhere, the Shanghai Comp (-6.4%) weakened despite the largest liquidity injection conducted in 3 years, as oil weakness dictated sentiment, while outflow concerns also added to the downbeat tone. As a reminder, the ASX 200 was closed today due to Australia Day holiday. Finally, 10yr JGBs traded relatively flat, failing to sustain most its early advances despite weakness in stocks, as participants remain tentative ahead of Friday’s BoJ policy decision.

Top Asian News

Leave A Comment