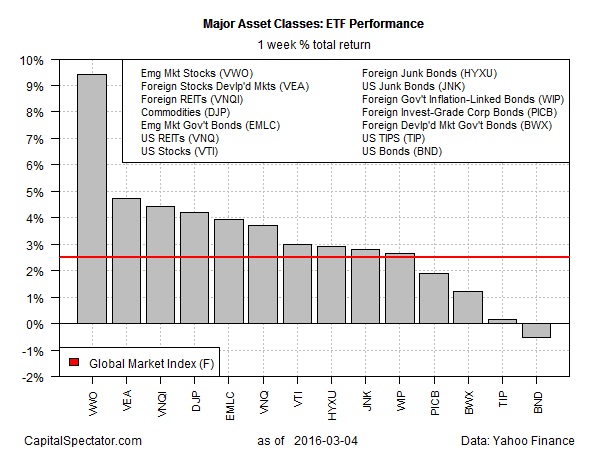

Risky asset roared back to life last week, led by a surge in surge in equities in emerging markets, based on a set of ETF proxies for the major asset classes. For the third straight week, there was a risk-on bias for the five trading days through Mar. 4.

Stocks in emerging market were the clear winner for the week just passed. The Vanguard Emerging Markets ETF (VWO) soared 9.4%, which boosted the fund to its highest price since late-Dec. The only loser last week: investment-grade bonds in the US. The Vanguard Total Bond Market ETF (BND) inched down by 0.5%, the first weekly loss for the fund since mid-January.

Meanwhile, the upside bias in markets around the world provided more lift to an ETF-based version of the Global Market Index (GMI.F)–a passively managed benchmark that holds all the major asset classes in market-value weights. GMI.F jumped 2.5% last week, which marks the benchmark’s third gain in as many weeks.

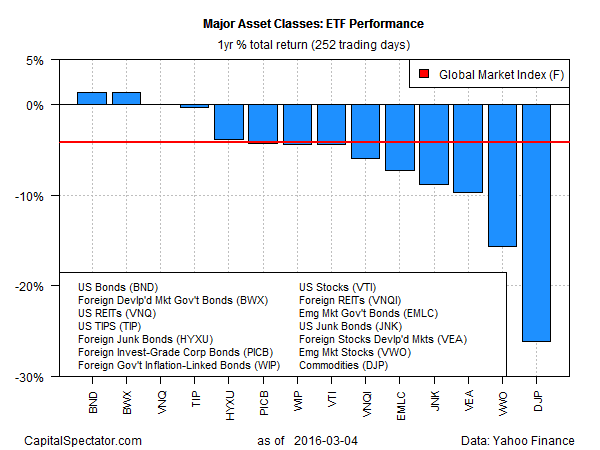

The recent gains are encouraging, but there’s still a long way to go to reverse the red ink that continues to color the trailing one-year profile for the major asset classes. US investment-grade bonds (BND), foreign government bonds in developed markets (BWX), and US REITs (VNQ) are posting slight gains vs. year-earlier levels. The rest of the field continues to wallow in varying degrees of loss. Broadly defined commodities (DJP) remain dead last, suffering a 26% retreat for the past year.

The good news is that there’s a whiff of upside momentum in the air. It’s anyone’s guess if the global gloom has run its course and we’re in the early stages of an extended rally. Or is this a sucker’s rally? No one really knows at this point, but for the first time in 2016 there’s a tailwind blowing through global markets. The main question now: Can the bulls make it four weeks in a row?

Leave A Comment