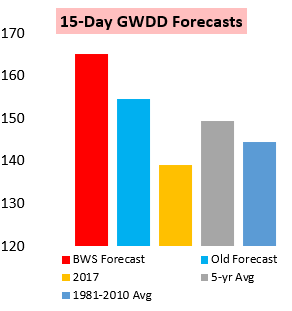

Natural gas prices rallied as forecasts warmed significantly for the end of August. Our Morning Update indicated an increase of over 10 GWDDs from our forecast the previous day.

We outlined these changes were likely to put resistance from $2.95-$2.96 in play today, with prices spiking just above that level before pulling back in the afternoon and settling just below it.

However, we also highlighted that some trends back cooler in the short-term were possible in afternoon 12z guidance.

The result is that September natural gas prices settled up over a percent on the day but solidly off the highs.

In our Morning Update, we highlighted that weather was very likely to drive price action through the day today, and this mainly was due to the forward curve structure indicating prices were primed for a weather-driven move. They retained that structure into the end of the day, with by far the largest move right at the front of the strip as most 2019 contracts lagged.

These warmer trends were certainly not a surprise either, as they were the subject of our intraday Note of the Day for clients yesterday.

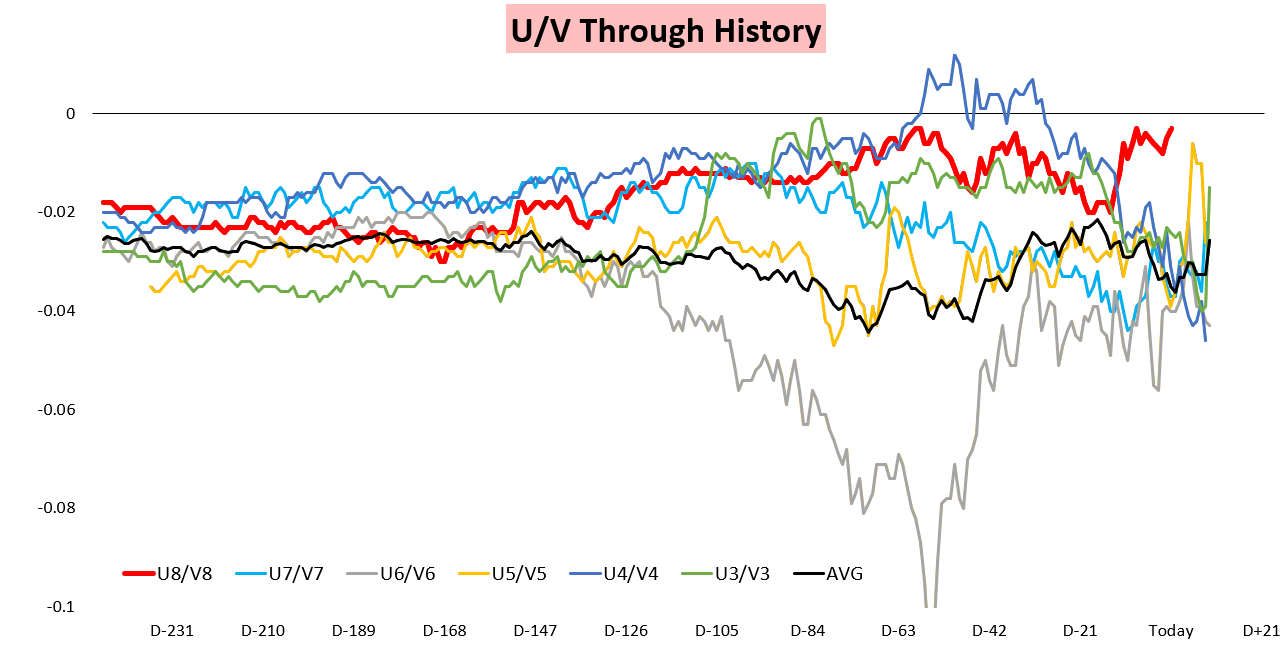

They also pulled the U/V September/October contract spread back to recent highs, even as cash prices dipped a bit today.

This ends a week where the front of the natural gas strip actually barely moved at all; the September contract settle today was just 2 ticks above the settle last Friday.

Meanwhile, the role of strong cash prices through the week is clearly seen in how elevated the U/V spread has remained relative to historical levels.

Leave A Comment