Introduction

In the winter of 2008, I was teaching at the University of Palermo (UP) in Buenos Aires. We were in a tall building overlooking the port and I noted an excess of ships in the harbor. It turned out this was happening all over the world because the letters of credit written by banks for cargo were not being accepted by other banks. It was the beginning of what became the largest downturn since 1929.

In the following year, I got my UP students to write essays on how the major Latam countries were coping with the downturn. At that time, the countries could be placed in three groups: Chile, Mexico and Peru coping well, Brazil and Columbia were coping OK while Argentina, Ecuador, and Venezuela were having real problems. At the time, I said the following about Brazil:

Brazil is well on its way to becoming one of the strongest world economies. With a low population density (22.5 persons/sq. km) versus China (141.7) and India (380.0), and abundant natural resources, the future is bright.

So much for the accuracy of my predictions. In the following paragraphs, I look at the economic prospects for these countries from a 2016 perspective.

Growth Rates

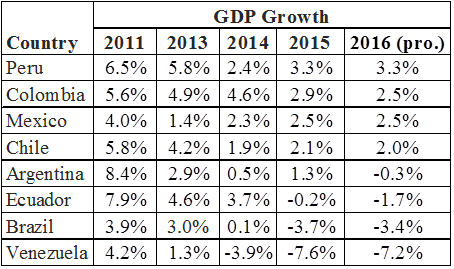

Table 1 provides real GDP growth rates for selected Latam countries ranked by their projected 2016 growth rates. Three countries – Brazil, Ecuador, and Venezuela are in dire straits for reasons documented below. As I have suggested in a recent piece, there is renewed hope in Argentina: while the consensus forecasters of FocusEconomics are quite bullish on the country in 2017, they believe 2016 will be slow as “resource allocation adjustments” are made.

Table 1. – Real GDP Growth Rates, Selected Latam Countries

Source: FocusEconomics

In the following paragraphs, the reasons for these growth rate projections are examined.

Exports

Consider next the export performance of Latam countries (Table 2). There are several factors at play here among which lagging growth rates in China and commodity price declines are probably key.

Leave A Comment