In this article I will assess the strength of U.S. economic activity by analyzing the components of The Conference Board’s (hereafter “the CB”) Leading Economic Index, along with a few additional indicators. Overall, the analysis indicates a significant slowdown in U.S. economic activity, and the possibility of a recession in 2016, based on: 1) lack of growth in consumer and capital goods orders, 2) a range-bound stock market and flattening yield curve, 3) a multi-year trend of slowing sales growth, 4) unsustainable increases in business and consumer borrowing, 5) an elevated inventory-to-sales ratio, 6) commodity price deflation and 7) the complete exhaustion of Federal Reserve monetary policy.

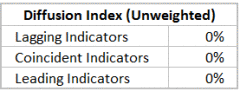

The analysis method is to individually rank each Conference Board indicator -1, 0, or +1 (negative, neutral or positive, respectively) and to average these rankings two ways. The first way treats each indicator equally, while the second uses the weighting system employed by the CB. The possible range of scores is from -100%, which would represent a severe recession, to +100%, which would represent robust expansion. The summary table below previews the results of the analysis. According to the equally-weighted method, past, present and future economic activity in the U.S. has been hovering close to stall speed — neither expanding nor contracting (0% diffusion index values). Using the CB’s weightings, which more heavily emphasize manufacturing activity, interest rates and consumer sentiment, the U.S. economy is expected to remain in a sluggish, slow-growth mode for the first half of 2016 (a 23% diffusion index value corresponds to slow growth). If business activity continues decelerating, however, the economy will most likely slip into recession sometime in 2016.

The most heavily-weighted component is the Average Length of the Manufacturing Workweek (weight = 27.8%), shown below with the Average Length of the Construction Workweek. The manufacturing workweek has averaged 41.8 hours — exactly — for the past 8 months (which raises questions about the validity of the reported data). The length of the construction workweek is also at multi-year highs.

Leave A Comment