An interesting symposium in the 2nd Quarter 2018 issue of Choices, published by the Agricultural and Applied Economics Association, deals with the impact of Chinese trade retaliation aimed against US agricultural exports.

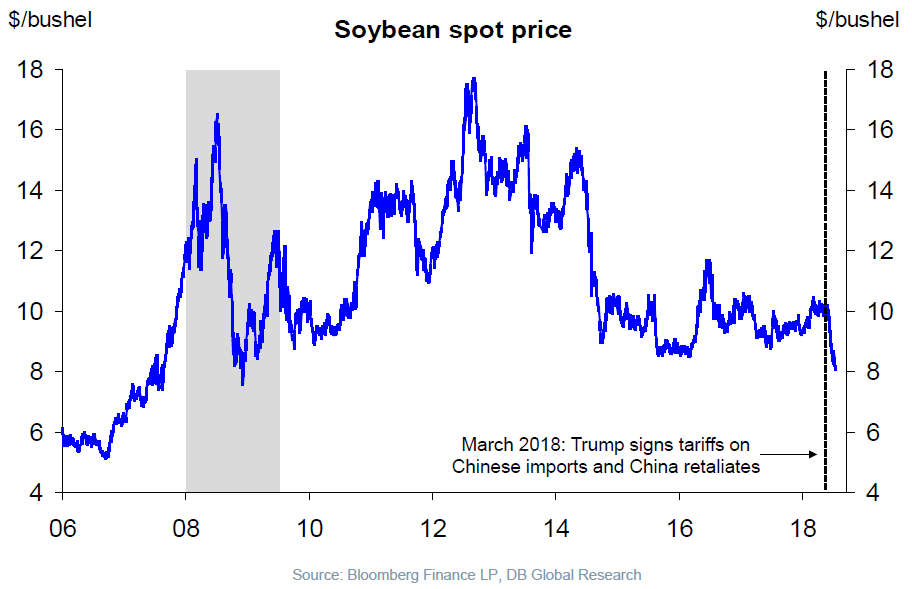

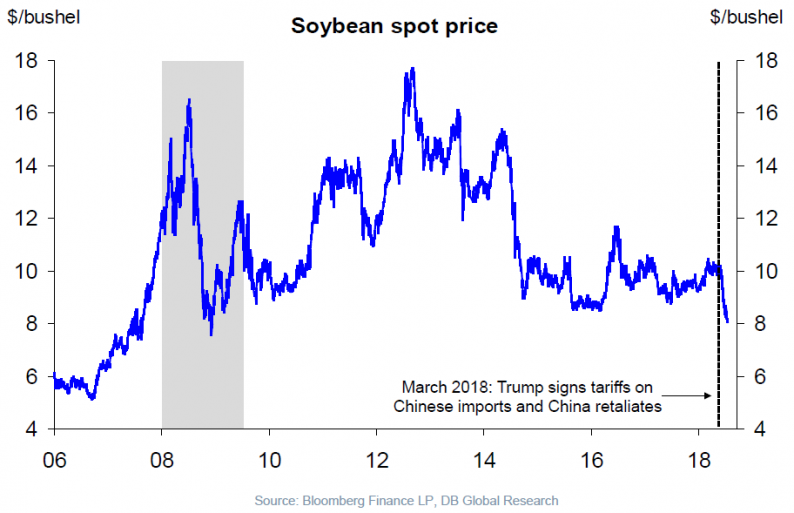

Some reading to contemplate this graph by:

Source: Slok, “Global markets: US overheating and Treasury supply pushing US rates up. Trade wars and Turkey pulling US rates down,” Deutsche Bank, September, 2018.

What Have We Learned from China’s Past Trade Retaliation Strategies? (pp. 1-8)

Minghao Li, Wendong Zhang and Chad Hart

Theme Overview: U.S.–China Trade Dispute and Potential

Impacts on Agriculture (pp. 1-3)

Mary A. Marchant and H. Holly Wang

Predicting Potential Impacts of China’s Retaliatory Tariffs on the U.S. Farm Sector (pp. 1-6)

Yuqing Zheng, Dallas Wood, H. Holly Wang and Jason P. H. Jones

Impacts of Possible Chinese 25% Tariff on U.S. Soybeans and Other Agricultural Commodities (pp. 1-7)

Farzad Taheripour and Wallace E. Tyner

Upheaval in China’s Imports of U.S. Sorghum (pp. 1-8)

James Hansen, Mary A. Marchant, Wei Zhang and Jason Grant

Chinese Trade Retaliation May Diminish U.S. Wine Export Potential (pp. 1-7)

Amanda M. Countryman and Andrew Muhammad

China’s Potential Cotton Tariffs and U.S. Cotton Exports: Lessons from History (pp. 1-6)

Yangxuan Liu, John R. C. Robinson and W. Donald Shurley

Some interesting tidbits:

Leave A Comment