Here we go again – Fed Day, March 2017. While this is but the first of several central bank meetings this week – the Bank of Japan, the Bank of England, and the Swiss National Bank are also slated to meet – the gathering of Janet Yellen’s bunch is likely the most important.

The futures market is pricing in a nearly 100% chance that Yellen & Co. are going to raise the Fed Funds target rate by 0.25% today. As such, there is likely to be very little drama surrounding the announcement.

However, this does not mean that there won’t be drama, or perhaps more accurately, volatility, when Janet Yellen starts taking questions from the press later this afternoon. You see, today isn’t so much about what the Fed is doing now, but rather what they are going to do in the future.

At this stage, the consensus thinking is that the Ms. Yellen will raise rates three times during calendar year 2017. Thus, if there is any commentary suggesting otherwise, the trading computers will likely start to hum.

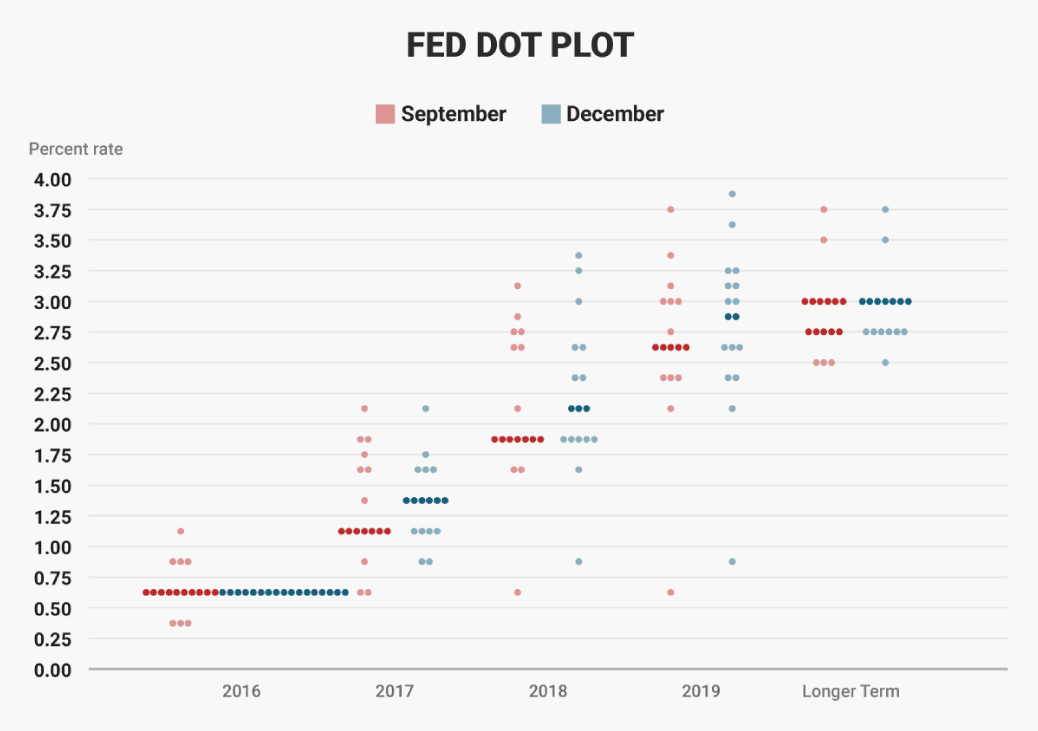

One key that most everyone will be watching today is the “Dot Plot” – a chart showing where each FOMC member expects interest rates to be going forward. In case you aren’t familiar, below is the now famous “dot plot” chart.

If one “follows the dots” over time (the chart above compares the “dots” from the September and December meetings), the Fed’s thinking can become clear. As such, where the “dots” fall today will be heavily scrutinized.

Markets Waiting At Key Technical Levels

As for the markets, traders tend to position themselves at key technical levels in front of major events – and today appears to be no different.

For the bond market, the yield on the U.S. 10-Year Treasury Note is currently resting just below the all-important 2.6% level. Why is this rate important, you ask? In short, because (a) this was the high-water market during the “reset” after the election and (b) former “Bond King” Bill Gross says that a move above 2.6% would signal the start of a secular bear market in bonds.

Leave A Comment