Food for thought over the long weekend.

Why Tighten?

I hear a lot about why, despite (by some accounts) a measurable output gap, and low inflation, we need to tighten because of e.g., an incipient housing bubble (or some other unidentified asset bubble). Reuven Glick and Kevin J. Lansing and Daniel Molitor at the SF Fed deal decisively with the leverage-induced housing bubble meme:

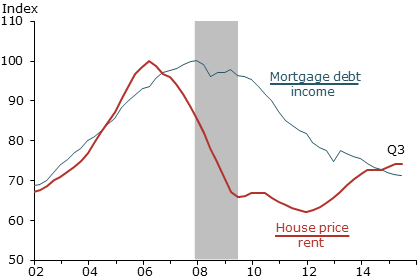

After peaking in 2006, the median U.S. house price fell about 30%, finally hitting bottom in late 2011. Since then, house prices have rebounded strongly and are nearly back to the pre-recession peak. However, conditions in the latest boom appear far less precarious than those in the previous episode. The current run-up exhibits a less-pronounced increase in the house price-to-rent ratio and an outright decline in the household mortgage debt-to-income ratio—a pattern that is not suggestive of a credit-fueled bubble.

Figure 2 from the Reuven Glick and Kevin J. Lansing and Daniel Molitor at the SF Fed conveys concisely and persuasively their argument.

Source: Reuven Glick and Kevin J. Lansing and Daniel Molitor at the SF Fed.

For me, I remain unconvinced that there is tremendous froth in financial markets thereby validating the case for tightening. At least, it doesn’t appear to be in the housing market.

Tightening Already Underway

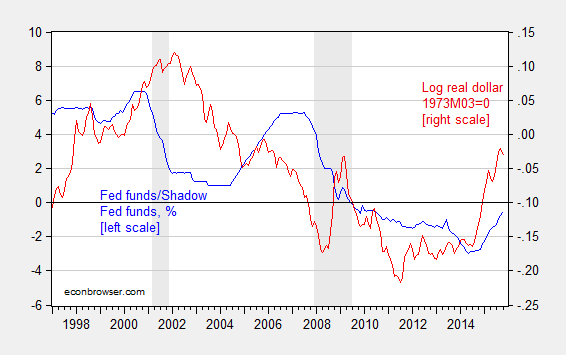

I’ve mentioned in an earlier post that the tightening has already begun, and dollar appreciation has in part signalled the reduced rate of Treasury accumulation by foreign central banks that in the past depressed long term yields. These trends are documented in Figure 1.

Figure 1: Fed funds/Shadow Fed funds rate (blue, left scale), log real trade weighted dollar – broad index, 1973M03=0 (red, right scale). NBER defined recession dates shaded gray. Source: Federal Reserve Board, Wu-Xia, NBER, and author’s calculations.

What is going to happen when the Fed actually raises rates? This is an interesting question, which is related to the trilemma. Joe Joyce at Capital Ebbs and Flows

contrasts the views of Helene Rey (there’s only a dilemma) vs. those of Klein-Shambaugh, Popper-Mandilaris-Bird, and Aizenman-Chinn-Ito (there’s a trilemma). Professor Joyce sides with exchange rate regimes as still mattering, but re-interprets the Rey thesis:

Leave A Comment