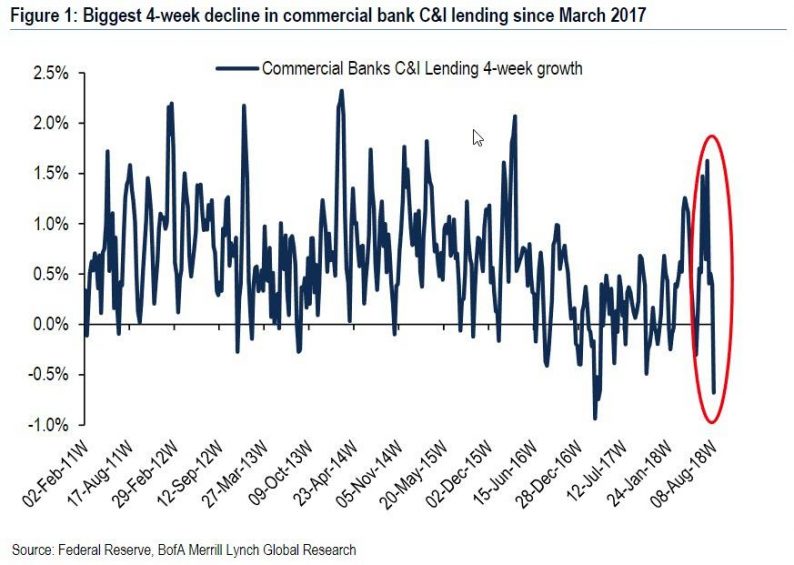

After a period of surprisingly strong growth following the near contraction in early 2017, commercial bank C&I lending tumbled during the period July 11th to August 8th by $15bn, or 0.68% – the biggest 4-week decline since March 2017 and before that the aftermath of the financial crisis.

That period mostly follows the relevant time frame of reference for the most recent Senior Loan Officer survey, which as we noted previously, showed banks loosening lending standards and small increases in loan demand just as the loan bubble – which has grown to a $1 trillion size and is rapidly closing in on the entire US junk bond market – showed first signs of popping.

What is causing the unexpected slump? According to Bank of America, it appears that – despite such favorable survey results – commercial banks are having an unusually slow summer in terms of lending activity to companies.

As we would think that banks are unlikely to have suddenly decided to flip and tighten lending standards, the reduction in C&I lending activity is likely driven by demand.

This is troubling, and probably indicates that companies this year are finally responding to the increase in the relative cost of debt by using less of it, especially when M&A activity is subdued as we are seeing right now.

And if rates continue to rise – as they most likely will absent an unexpected dovish turn by the Fed in coming months – it would indicate that for the majority of US corporations the clearing level of rates has finally been hit, with loan demand expects to accelerate to the downside, hitting not only bank interest income, but also the broader economy as the average US company hits a growth plateau, with significant consequences for both corporate earnings growth and the broader economy.

Leave A Comment