London house prices fall in September: first time in eight years

– High-end London property fell by 3.2% in year

– House sales down by over a very large one-third

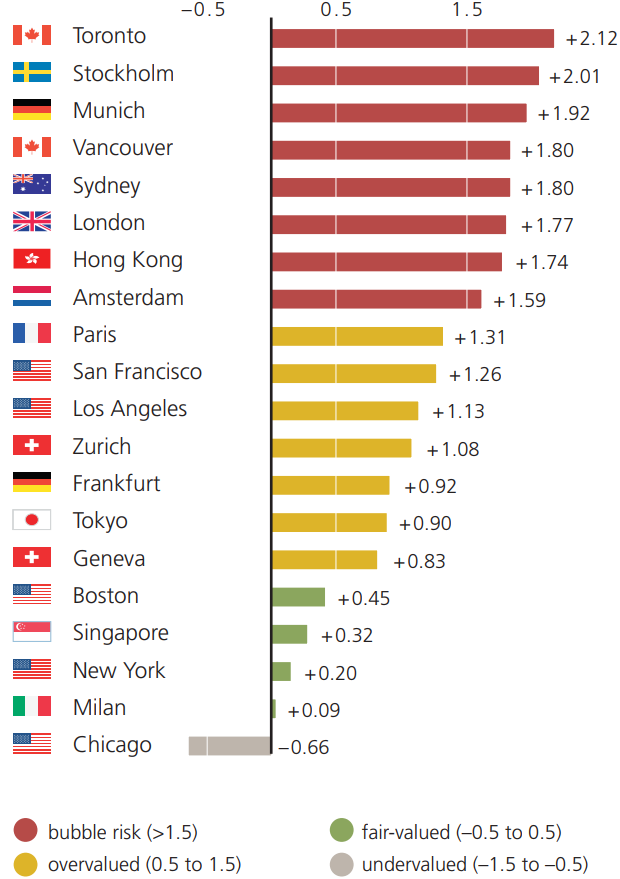

– Global Real Estate Bubble Index – see table

– Brexit, rising inflation and political uncertainty causing many buyers to back away from market

– U.K. housing stock worth record £6.8 trillion, almost 1.5 times value of LSE and more than the value of all the gold in world

– Homeowners and property investors should diversify and invest in gold

In what might be a sign of things to come, London house prices have fallen for the first time in eight years.

London house sales have fallen by a third as years of frenzied bidding come to a shuddering halt.

The capital remains expensive. Housing still costs 10 times the average salary and only 50% of Londoners own their own homes, the EU average is 70%.

Currently the rest of the UK appears to be benefiting from the lack of affordability and stock in London. Buyers are moving further out of the capital in order to secure their footing on the housing ‘ladder’… no snakes here …

Last month U.K. house prices regained their fastest pace since February. A Halifax house price survey showed a 4% price rise in the three months to September compared with the same period last year.

Long-term, a fall in London prices may be an indicator that concerns over Brexit, inflation and political stability are beginning to affect the U.K property market.

This will be a hard landing for a country that is so convinced that putting all one’s eggs in the housing basket is the answer to securing and growing wealth.

‘Global Real Estate Bubble’

Last month, UBS Wealth Management published its Global Real Estate Bubble Index. London came sixth with a score of 1.77. The group concluded that London is still firmly in bubble-territory.

The research found that London house prices have climbed 15% in the last year and 45% since the financial crisis, when adjusted for inflation.

This suggests September’s fall in prices might be a signal that the top of the market is just behind us. This is no surprise when one considers both the known and unknown events on the horizon for the city.

Brexit is the most discussed threat. Foreign buyers are wary of what the future holds and there is anecdotal evidence that EU workers are being offered shorter contracts. Four years ago foreign buyers accounted for 82% of property purchases.

Leave A Comment