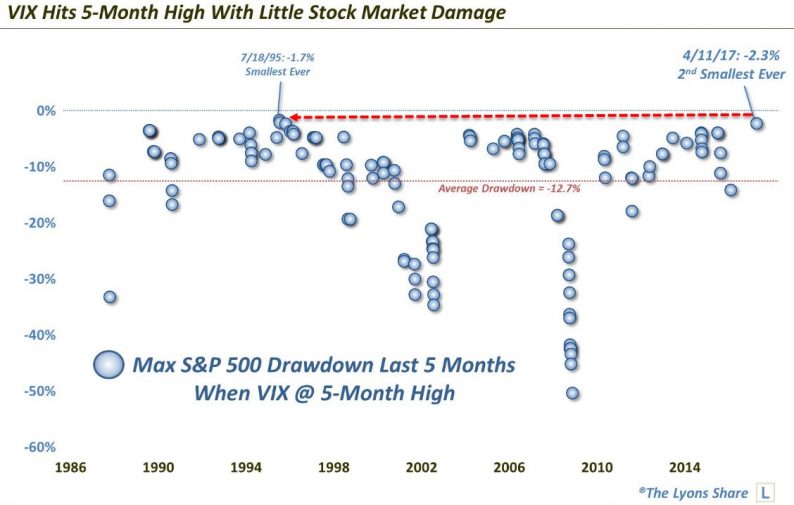

The stock market had another small drawdown on Wednesday as it is down about 2.5% from its all-time high. The last 5% decline was in June 2016 which is about ten months ago. The minimal size of the stock market correction is remarkable when you look at in the context of other markets. As I mentioned in a previous article, the VIX had been rising along with the S&P 500 which is rare. I noticed this has been happening more frequently in the past few weeks. Now I have evidence which proves the VIX’s relationship with the S&P 500 has been wacky lately. The chart below says the stock market is having its second smallest correction with the VIX at a five-month high. One point which downgrades the importance of this move in the VIX is that the VIX had its second lowest quarter in Q1 which means a five-month high isn’t as high as most of the previous five highs.

Along with the increasing VIX, the ten-year bond has been rallying sharply which indicates growth will come in below blue-chip expectations. As I’m writing this post, the ten-year bond yield is at 2.2605% which is below the lows of the range it had been in. This rally goes exactly against the Fed’s rate hikes and unwind of its balance sheet. It shows the Fed has less influence on the long bond than it thinks. It also shows the ten-year and the VIX are more in-line with the bearish Atlanta Fed GDP forecast than the stock market is. The stock market is more resilient because of the dumb money flowing into it.

The dollar also fell Wednesday because Trump said it was overvalued. In terms of the currency wars, Trump hasn’t done anything too dramatic in terms of action (not rhetoric). The best summary of the Trump administration thus far is both the positive and the negative expectations aren’t being realized. Tax cuts haven’t happened and there hasn’t been a trade war. In an interview with Maria Bartiromo, Trump said healthcare reform must come before tax cuts because the money saved from healthcare reform will fund the tax cuts. This is what I’ve been saying for a few weeks. On the other hand, Trump’s meeting with Chinese President Xi Jinping was mainly amicable. Trump got China to give the U.S. better access to financial sector investments and beef exports. In summary, the market got the Trump administration exactly wrong as the tax cuts haven’t come through and instead of a trade war with China, Trump made a deal which may improve U.S. China relations and improve both economies.

Leave A Comment