Following futures positions of non-commercials are as of August 14, 2018.

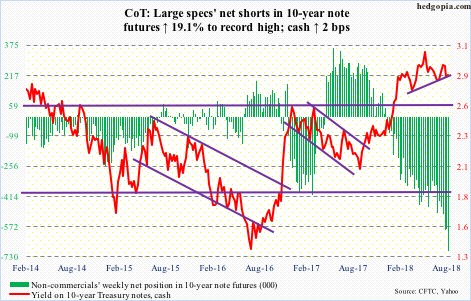

10-year note: Currently net short 698.2k, up 111.9k.

In the 12 months to July, the US Treasury issued $544.1 billion in notes and bonds. A year ago, issuance totaled $335.1 billion. In the 12 months to June, the federal budget deficit totaled $749.8 billion, down from $765.2 billion in May, but this has persistently risen since bottoming at $403.6 billion in January 2016. In all probability, thanks to last December’s tax cuts and subsequent increase in the budget, the red ink only grows from here. Bond vigilantes know this. In the meantime, foreigners have reduced their purchases of T-notes and bonds. In the 12 months to June, they in fact sold $7.4 billion worth, versus purchases of $92.2 billion in February. Plus, the Fed has been cutting back on its treasury holdings. It currently holds $2.17 trillion in notes and bonds, down from $2.35 trillion in October 2014.

Yet, the 10-year T-yield (2.87 percent) cannot rally. Well, it did rally from 2.03 percent last September but hit the wall north of three percent. In May, yields rose as high as 3.12 percent, before coming under pressure. This week, bond bears defended the neckline of a potentially bearish head-and-shoulders formation. A convincing break has the potential to squeeze non-commercials, who are heavily net short 10-year note futures – another record. Should this unfold, rates in due course can come under more pressure.

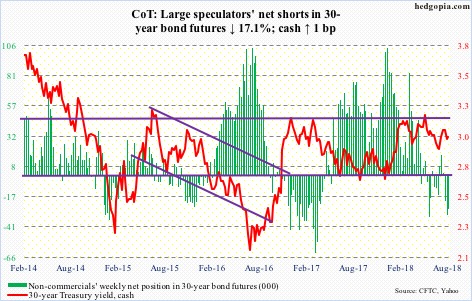

30-year bond: Currently net short 26.5k, down 5.4k.

Major economic releases next week are as follows.

Wednesday brings July’s existing home sales as well as FOMC minutes for the July 31-August 1 meeting.

Sales fell 0.6 percent month-over-month in June to a seasonally adjusted annual rate of 5.38 million units. Last November’s 5.72 million was the highest since February 2007.

New home sales for July are on tap Thursday. June was down 5.3 percent m/m to 631,000 units (SAAR). Last November’s 712,000 was the highest since October 2007.

Also on Thursday, the annual Jackson Hole symposium begins and runs through Saturday.

July’s durable goods orders are scheduled for Friday. June orders for non-defense capital goods ex-aircraft – proxy for business plans for capex – jumped 7.8 percent year-over-year to $68.5 billion (SAAR).

Leave A Comment