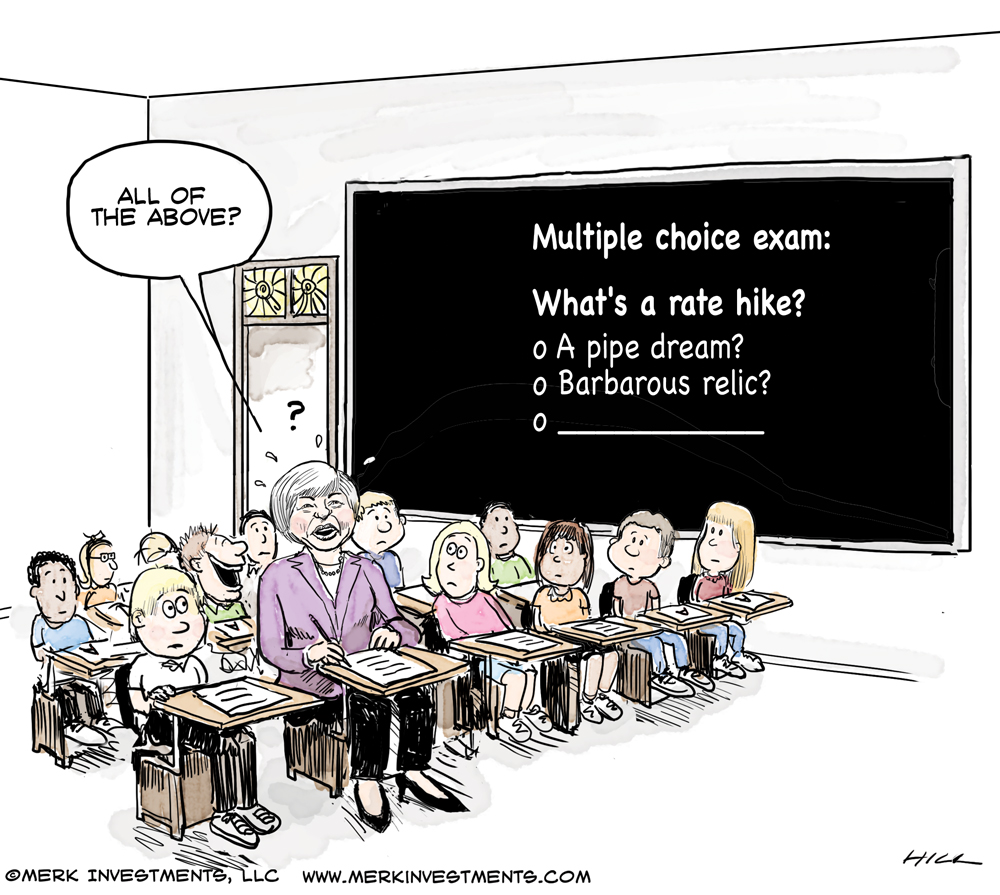

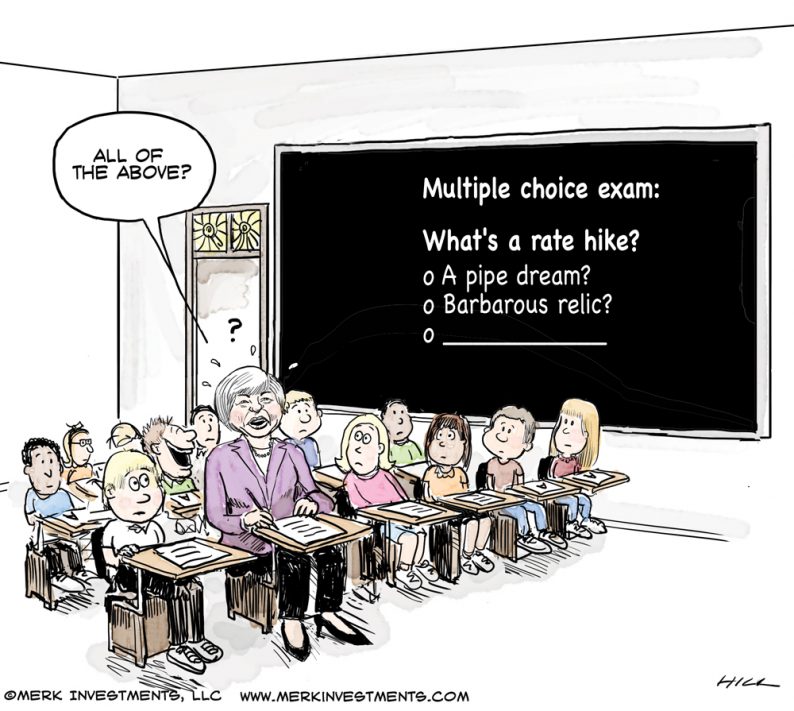

Will she raise or will she not? As financial markets focus on whether we will see a Fed rate hike this week, investors may be in for a rude awakening.

Why do we care about the Fed?

We care about the Federal Reserve (Fed) because it controls short-term interest rates and the underlying money supply that’s available to the banking system. What the Fed does with these controls has implications to the credit (the ease and cost of borrowing money) that is available to the broader economy (for corporate loans, household mortgages, etc.).

What is the Fed’s job?

Most central banks have a single mandate to keep inflation low and stable. The Fed, under former Fed Chair Bernanke’s leadership, has adopted an explicit 2% inflation target. In addition, Congress bestowed upon the Fed the mandate to maximize employment. And, because it appears so convenient for Congress to outsource seemingly everything to the Fed, it now has the responsibility to also provide financial stability.

What has the Fed achieved?

In our assessment, the Fed has achieved one thing: they have compressed risk premia. What? What about inflation, employment, financial stability, and what the heck does it mean, “the Fed has compressed risk premia?”

We focus on risk premia because, in our view it’s the only obvious achievement of the Fed, but it also has profound implications for investors. Wikipedia defines risk premium as follows:

Let’s try this again: when risk premia are compressed, risky assets are not expected to provide much additional return compared to a “risk-free” asset. This is noticeable, for example, in the low yield spread between junk bonds and U.S. Treasuries (i.e. the risk premium).

Central banks around the world have attempted to stimulate their economies through lowering short-term interest rates and engaging in “quantitative easing,” with the goal of making it easier and cheaper for corporations and households to borrow and spend money (the source of economic growth according to theory followed by many academics and policy makers). This theory is questionable at best and there may always be unintended consequences. Lower interest rates have lead to yield chasing in riskier assets and provided justification for high equity valuations on the back of a low discount rate in fundamental models. Meanwhile, there may be relatively little borrowing for purposes of productive projects that create goods and services with real underlying consumer demand.

Leave A Comment