Central Bankers Flip Flop

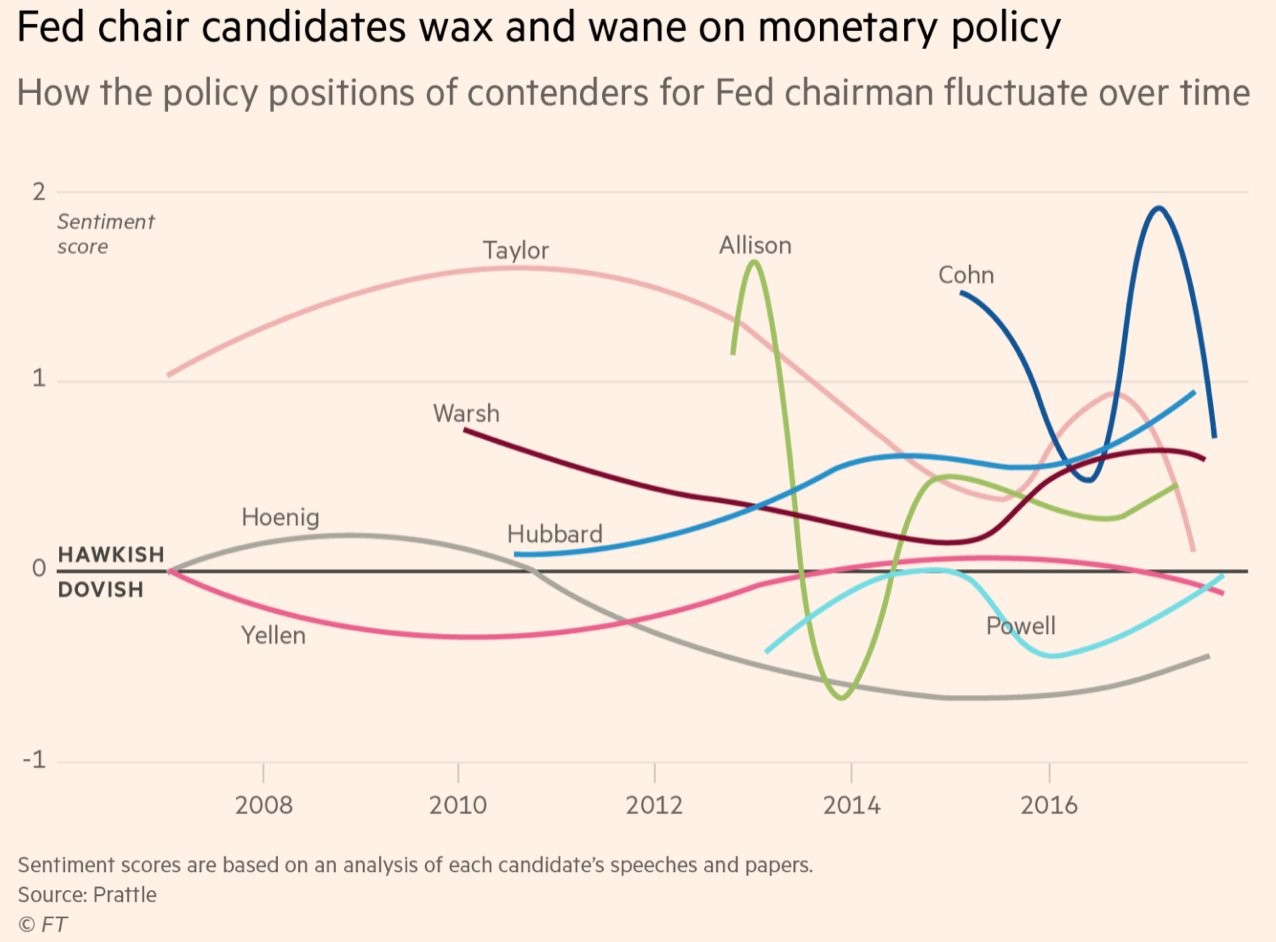

It appears that President Trump will pick Powell in the next few days as there’s an 86% chance on the PredictIt website. While the decision is known, the chart below provides context to how it may have been made. As you can see, the chart shows the policy positions of each potential candidate. Many of the candidates moved in the dovish direction. This is clearly an estimate because these candidates don’t take tests to determine their exact position. When I describe their positions, I can only look at quotes and analysis. I can’t predict when they might change their opinions on policy. Some positions like Warsh’s steadfast opposition to QE probably won’t change. As you can see, Yellen has been fairly consistent in her positioning. Powell has fluctuated more, but ends near the same place as Yellen. That’s different from other research which says he’s very dovish. This analysis is a preview of what’s to come in Powell’s first speech as chair. Yellen’s press conference in December will be her chance to leave her mark on monetary policy just like Jackson Hole except at this one everyone will know she’s leaving.

Leverage by Income

The inequality gap is important to measure because it shows the strength of the middle and lower income consumer, which is important to GDP growth. According to the Gallup survey, there were gains in middle income and lower income people when asked about how much they’d spend on Christmas gifts. The chart below is breakdown of the leverage among consumers by income group. It’s only updated to reflect 2016 data, but it’s still valuable to review. As you can see, the bottom 20 percentile group has the highest median leverage ratio compared to other years. Having more leverage than 2007 is hugely problematic as that year was prior to the financial crisis. To be clear, this doesn’t mean a recession is coming; it’s reflective of the inequality trend continuing. The richest 10 percent is doing the best in 2016 as compared to the other years as this expansion has allowed those people to deleverage. This all adds up to the overall number showing 2016 to have the 3rd most leverage out of the few years shown as the rich somewhat makeup for the leverage the lower income people have taken up. Tying this together with the Gallup poll, it’s possible some poor people are ready to spend more money by taking out debt.

Leave A Comment