Image Source: PexelsHere is a brief overview of various economic factors that may play a part in the day’s trading.

Image Source: PexelsHere is a brief overview of various economic factors that may play a part in the day’s trading.

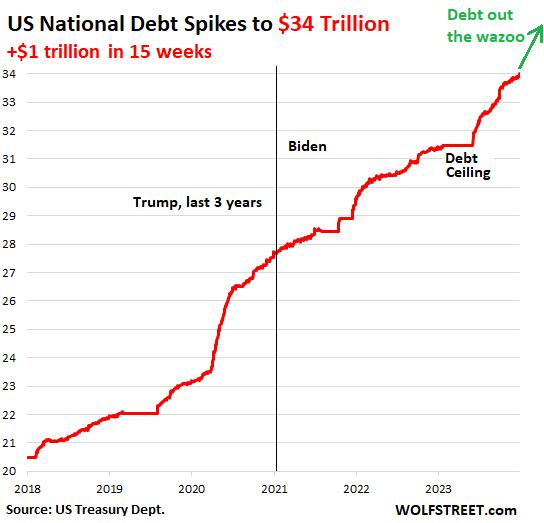

Rising US debt is a “boiling frog” for the US economy, JPMorgan warns. “The problem for the US is the starting point; every round of fiscal stimulus brings the US one step closer to debt unsustainability,” JPMorgan strategist Michael Cembalest says. “However, we’re accustomed to deteriorating US government finances with limited consequences for investors, and one day that may change.”He predicts that markets and rating agencies will force the government to make “substantial changes” for entitlement spending and taxes. “The US has run out of the road on that one,” Cembalest predicts for reductions in discretionary spending.

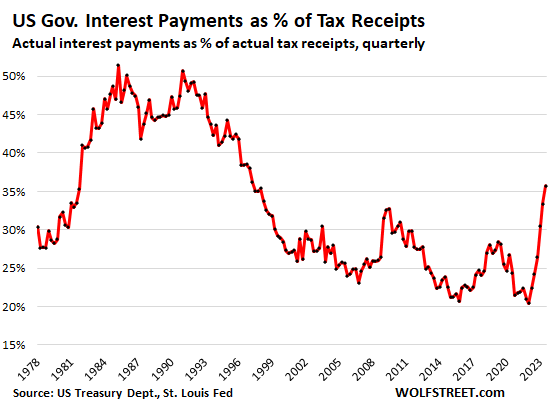

Rising US debt is a “boiling frog” for the US economy, JPMorgan warns. “The problem for the US is the starting point; every round of fiscal stimulus brings the US one step closer to debt unsustainability,” JPMorgan strategist Michael Cembalest says. “However, we’re accustomed to deteriorating US government finances with limited consequences for investors, and one day that may change.”He predicts that markets and rating agencies will force the government to make “substantial changes” for entitlement spending and taxes. “The US has run out of the road on that one,” Cembalest predicts for reductions in discretionary spending. WolfStreet.com notes: “Ultimately, interest payments threatening to eat up everything else appear to be the only disciplinary force left that is able to pressure Congress to do something beyond grandstanding, but obviously not yet.”

WolfStreet.com notes: “Ultimately, interest payments threatening to eat up everything else appear to be the only disciplinary force left that is able to pressure Congress to do something beyond grandstanding, but obviously not yet.” More By This Author:U.S. Q4 GDP Growth Expected To Support Soft Landing OutlookMarkets And Fed Minutes See Path For Rate Cuts In 2024Total Return Forecasts: Major Asset Classes

More By This Author:U.S. Q4 GDP Growth Expected To Support Soft Landing OutlookMarkets And Fed Minutes See Path For Rate Cuts In 2024Total Return Forecasts: Major Asset Classes

Leave A Comment