Since early 2016 we have been carrying forward a theme illustrating that until the macro trends in place since 2011 change, the situation would be as is, stocks trending up and the precious metals in consolidation/correction. The current trends were kicked off symbolically, and functionally to a degree, by the Fed’s concoction of Operation Twist, a plan with the expressed goal of manipulating the macro (or in the Fed’s word, “sanitizing” inflation signals). Until this year it has been the gift that keeps on giving to unquestioningly bullish stock market participants.

We have also carried a theme forward that in order for a bull view to be widely recognized in gold, a bear view or at least a relative bear view will need to come about on the stock market, whether that means stocks rise nominally or not (ref. 2003-2007 when stocks rose nominally, but declined in terms of gold).

Gold does not move. It does not do much of anything other than mark its holders’ place, while the asset world goes in motion (up and down). Gold is a stable asset and its perceived value will diminish in the eyes of the average market participant during the risk ‘on’ good times, as instigated by the Bernanke and Yellen Fed and its perceived value will increase in line with a shift in other assets from risk ‘on’ to ‘off’.

Most recently we highlighted the following… Gold and the Stock Market; It’s Not the Best of Both Worlds

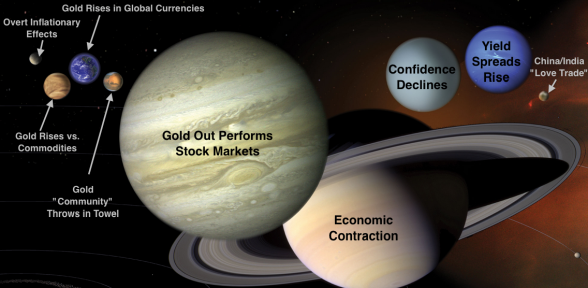

In short, the general conditions of our handy Macrocosm graphic need to come into place.

As for the gold miners, the case is amplified because when gold’s ‘real’ price, as measured vs. cyclical commodities and stocks rises the miners gain in two ways:

Leave A Comment