Despite a tough week for stocks into Friday, February 9, three big picture macro indicators have continued to support a risk ‘on’ backdrop. Many of the shorter-term indicators we watch, like junk bond ratios and the Palladium/Gold ratio say the same thing. Junk/Treasury and Junk/Investment Grade are threatening new highs and as we have noted in NFTRH updates all through the recent market volatility, Palladium (cyclical) got hammered vs. Gold (counter-cyclical), but only to test its major uptrend. Now the ratio is bouncing with the market relief that is so predictably taking hold (here’s a public post where we effectively called bullish, in day on that Friday).

As for the bigger macro indicators, the middle one, Amigo #2 (long-term interest rates) has that funny look on his face because he is bracing for something.

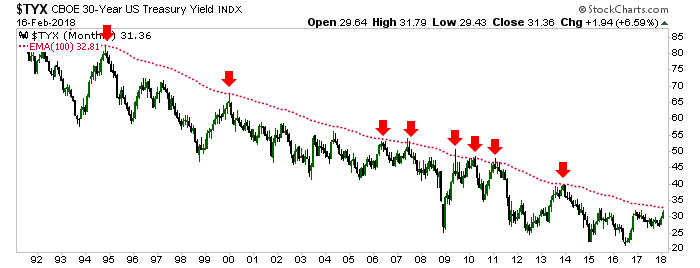

He is bracing himself for impact because he has already smashed into the 10yr yield target of 2.9% (it’s important for people making claims to be able to prove it, and so here again is the December 4 post making the 2.9% claim) and sees the limiter (red dashed monthly EMA 100) on the 30yr just ahead. He knows what happened every other time the yield approached the limiter over the last few decades. Smash! Meanwhile, the hype about the new bond bear market lives on.

Amigo #2 is probably going to encounter some resistance here because as noted in a previous post, the sentiment backdrop favors bonds right now. Against a range of portfolio long stock positions I’ve done some balancing not only with a few strategic short positions but yes, 3-7 year and 7-10 year Treasury bonds… the same bonds that are supposedly in a new bear market. If people liked them at the previous very low interest rates, they should love them now. But alas, that is not the way markets work.

On Feb. 12 we noted that the risk in the Treasury Bond market is in not having any Treasury Bonds and since presenting the sentiment and Commercial hedging data supporting a contrarian bullish view on the 10yr, the 30yr has improved as well to a contrary bullish stance. Here are the latest readings, courtesy of Sentimentrader.

Leave A Comment