Today’s employment situation release depicted a picture of continuing recovery in the labor market. One interesting aspect is what is happening to the tradables sector, which I proxy with the manufacturing sector. There, the advance data indicate a slight decline.

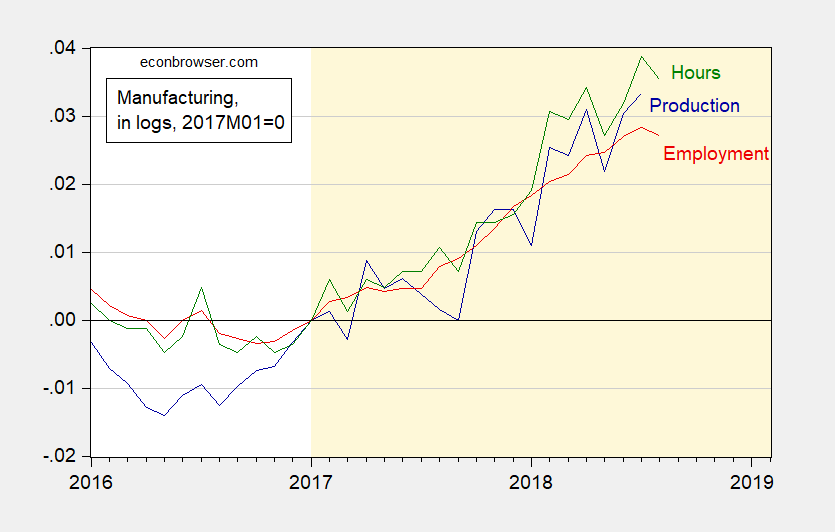

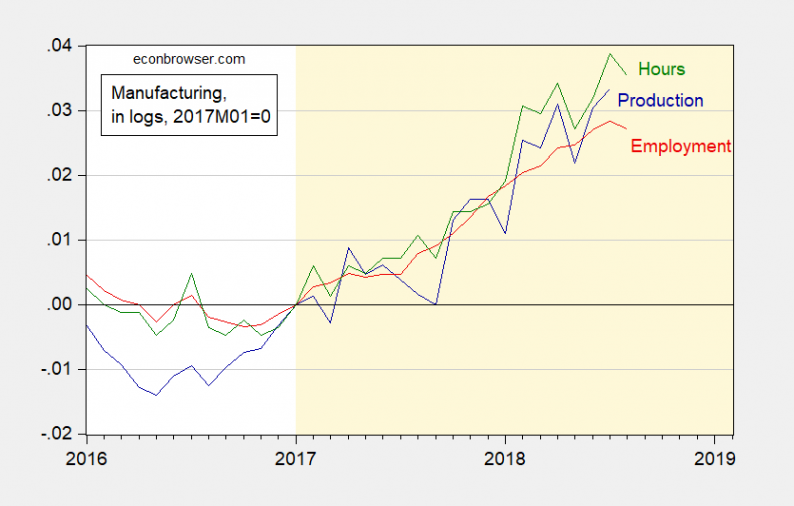

Figure 1: Manufacturing production (NAICS) (dark blue), manufacturing employment of production & nonsupervisory workers (red), aggregate hours of manufacturing employment of production & nonsupervisory workers (green), all in logs, normalized to 2017M01=0. Source: Federal Reserve, BLS, via FRED.

One observation is not a trend, so of course, one wouldn’t want to infer too much from these data points. However, if manufacturing output follows employment, and next month’s employment numbers follow this month’s trend, then it’ll be time to wonder if the combination of appreciated dollar, trade policy uncertainty and slowing growth abroad are going to hit the expansion.

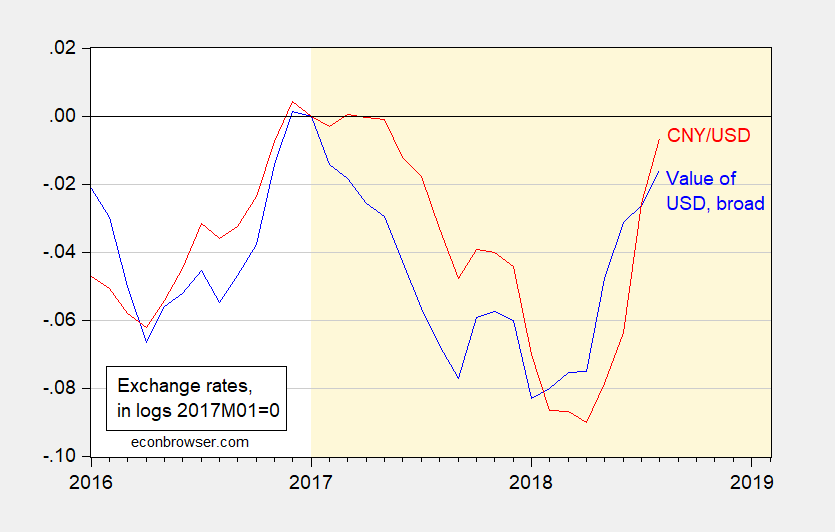

On the dollar, note that the upswing is partly due to incipient Fed moves, but some portion is due to heightened policy uncertainty and expansionary fiscal policy.

Figure 2: Nominal trade weighted dollar against broad basket of currencies (blue), and CNY/USD bilateral exchange rate (red), both in logs, normalized 2017M01=0. A rise is an appreciation of USD. Source: Federal Reserve Board via FRED, author’s calculations.

Leave A Comment