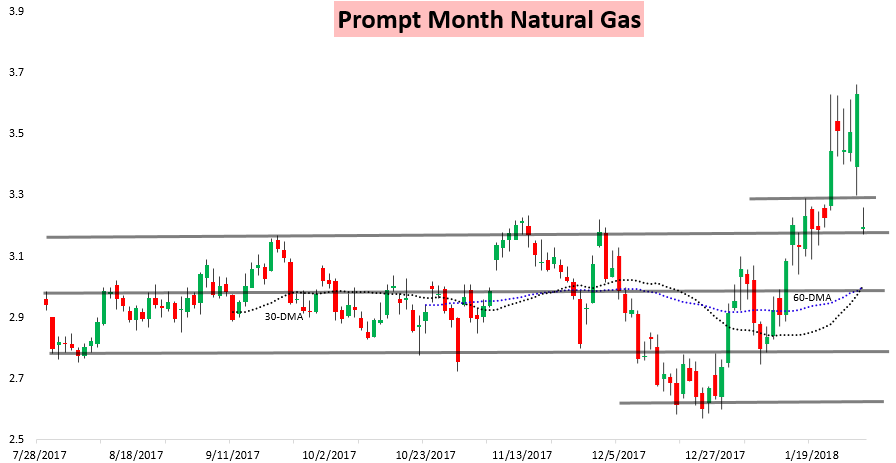

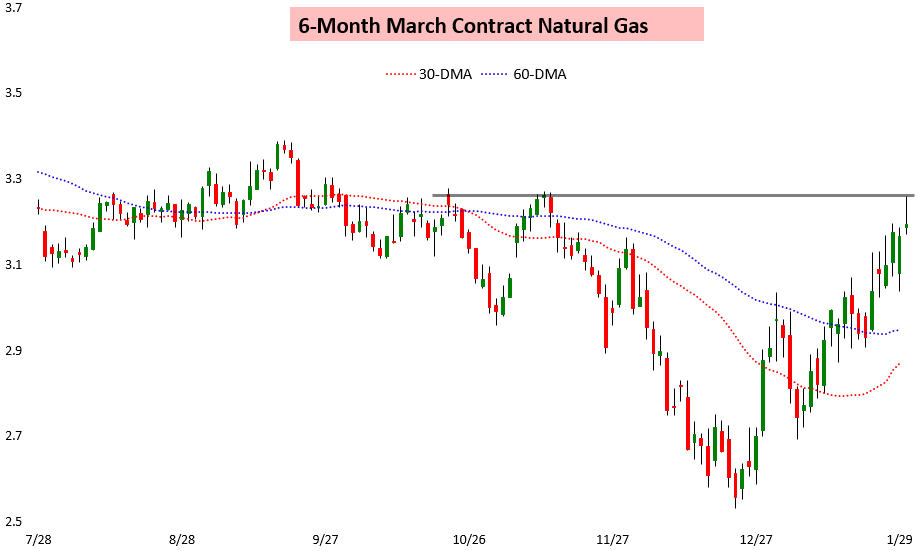

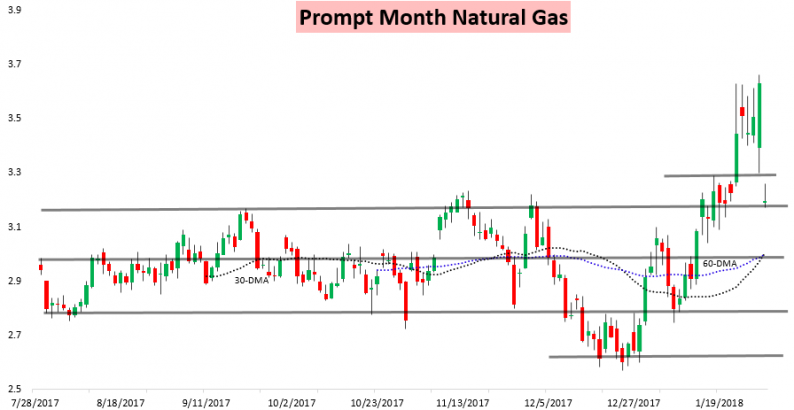

As one would expect, the March natural gas contract took over as the prompt month contract and instantly saw quite a bit of volatility, spiking overnight on cold weather models before reversing this afternoon on some warmer European model runs. On the prompt month chart, we see the discount the March contract now trades at compared to the February contract, and how March held support around $3.15.

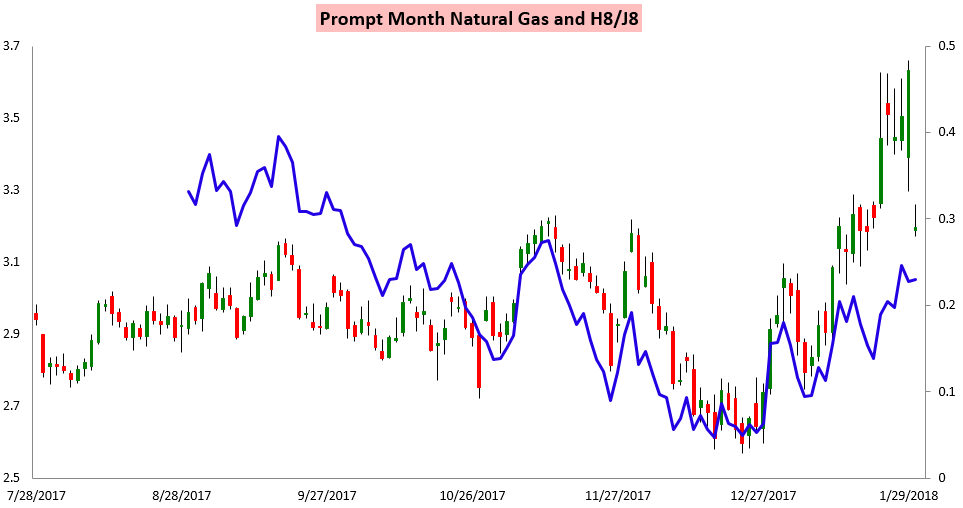

Technically the March contract led the way higher, though post-settle it declined below most other contracts along the 2018 strip.

Technically H/J ticked up on the day, though post-settle it is now back lower.

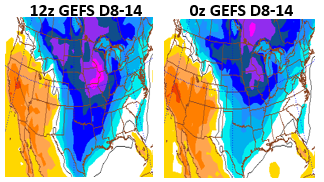

It was clear that the volatility through the day was driven by varying weather model guidance. Early afternoon GFS ensemble guidance trended even colder, as seen below courtesy of the Penn State E-Wall.

Yet the European ensembles trended warmer this afternoon (courtesy of True Energy, seen here.)

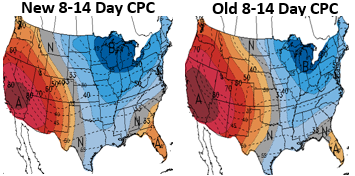

The result was an afternoon forecast where the Climate Prediction Center did not change forecasts much despite widely varying model output.

Price action early in the day easily vindicated our Note of the Day yesterday, which focused on the fact that weather models would provide further upside for prices.

In fact, the March contract hit its highest level since early November off the rally early today before reversing into the settle.

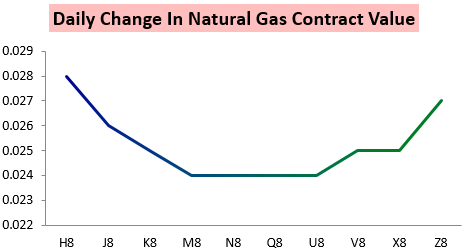

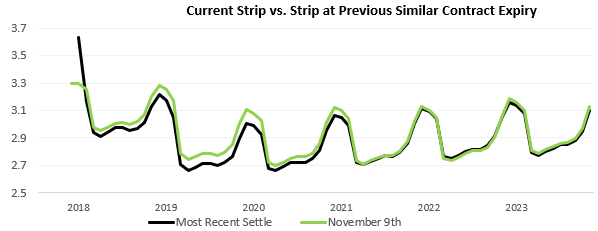

Today we released our Weekly Seasonal Trader Report for Trader level subscribers, which breaks down our GWDD forecasts for the next 5 months and analyzes where we see risks within the natural gas market. In it, we look at the change in natural gas prices since the last time the prompt month contract was at a similar level.

Leave A Comment