Financial stocks should benefit from phenomenal employment trends as well as rising rates. Yet the Financial Select Sector SPDR (XLF) is down roughly 12% from a 2018 high and down nearly 5% year-to-date.

Cyclical stocks should excel in a strong economic environment. Nevertheless, the iShares Transportation Average ETF (IYT) is down approximately 11% from its 2018 peak and down 3.5% this year.

Facebook, Amazon, Netflix and Google? Market-driving FANG stocks? Tech leadership is off anywhere from 16%-30% from record-breaking tops.

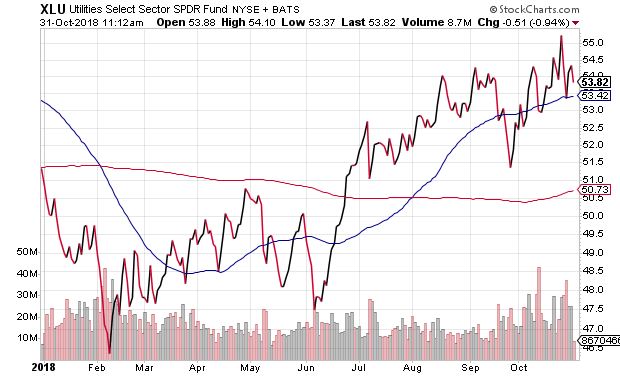

At present, there are only three economic sectors that boast technical uptrends. Consumer staples, utilities and healthcare. In essence, investors have shifted to a decidedly defensive stance, in spite of the reality that few economists see recession risks.

The fact that the investment community has shifted to a more defensive posture may not derail the bull, however. At least not in the near-term. Mutual funds close the books for the fiscal year today, Wednesday, October 31. Fund managers regularly sell their losers for tax purposes in October, then become buyers in November in an attempt to improve performance by year-end.

There’s more.

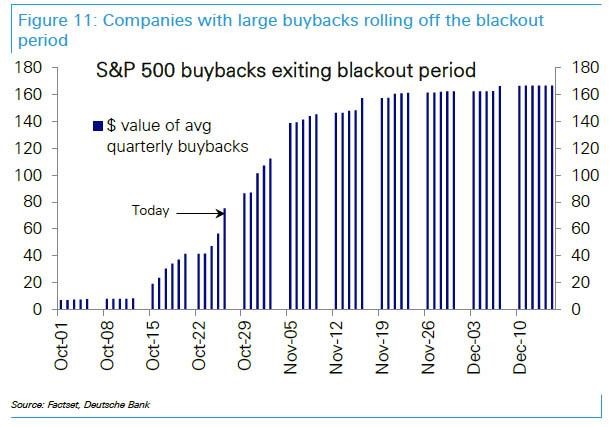

Not only will election angst terminate in the early part of November, but an increasing number of S&P 500 companies will be permitted to resume buying back their stock shares. In other words, when their “blackout periods” have run their course, buybacks may begin bolstering prices once again.

Granted, there are plenty of reasons to anticipate recovery for U.S. stocks in the near-term. On the flip side, the ongoing tightening campaign by the Federal Reserve remains the most critical element in play for asset prices worldwide.

With borrowing costs rising for dollar-denominated borrowers, European stocks in Vanguard FTSE Europe (VGK) and emerging stocks in Vanguard FTSE Emerging Markets (VWO) continue to lose significant ground. Meanwhile, the threat of an economic slowdown abroad, whether a function of tariffs or diminishing central bank support, has punished agricultural and metal commodities alike.

Leave A Comment