As you might expect from a reality TV show host, President Trump’s long selection process to identify the next Fed chair has increased the drama to record levels.

Yesterday’s headlines suggested Stanford University economist John Taylor made a favorable impression on the President last week. The creator of the famed “Taylor Rule” for formulaically determining the appropriate interest rate at any given time, Taylor is broadly seen as more hawkish than current Fed chair Janet Yellen.

Thus far, Trump has shown a penchant for hiring candidates with whom he has a strong relationship, though it is worth noting that he’s expressed that he would “like to see interest rates stay low” in the past, a potential knock against Taylor. In any event, news that Taylor’s proverbial “stock” was on the rise supported the greenback yesterday.

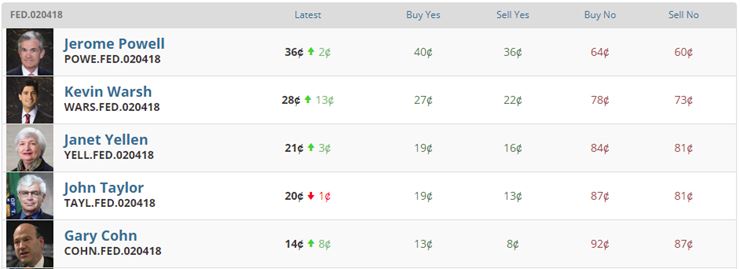

Lest they “jump the shark,” all good TV dramas must come to a timely end, and today’s news that Trump will announce his nominee for Fed Chair before November 3rd suggests that the end is in sight. According to sources, the President has narrowed his shortlist down to five candidates, including Taylor, Yellen, former Fed Governor Kevin Warsh, current Fed Governor Jerome Powell, and National Economic Council Director Gary Cohn. As the below prices from betting market PredictIt shows, punters see those five as the most likely candidates as well, though none of them are an odds on favorite:

Source: Predictit.org

Beyond the obvious implications for immediate Fed policy early next year, Trump’s decision will also shed light on how much importance he places on factors such as monetary policy track record, experience, and personal relationships when selecting economic policymakers. With the potential to nominate as many as five of the seven members of the Federal Reserve Board to 14-year terms over the next three years, the consequences of Trump’s decisions on this front cannot be overstated.

Leave A Comment