The tone from investors in the latest Bank of America survey is clear: as Michael Harnett summarizes it, the one prevailing theme is “unambiguous pessimism.”

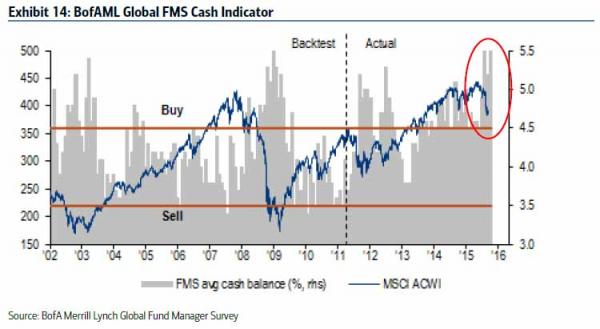

Some examples: “Asset allocators cut stocks & commodities (to 2008 levels) to seek the alternatives of bonds (highest allocation since May’13) with cash rising to 5.5%, equal to the 2008 highs.”

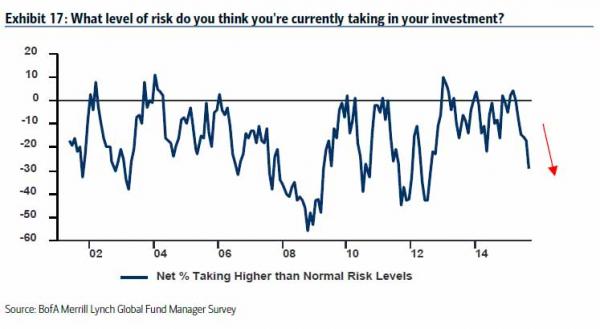

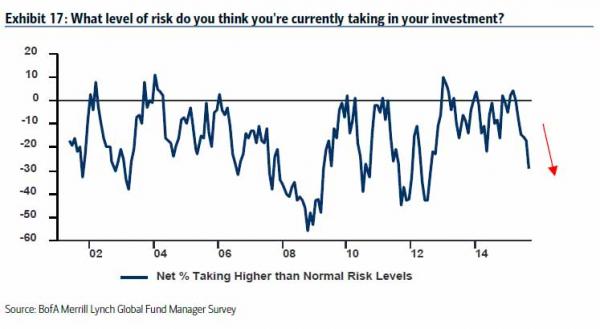

Nobody wants to take on risk: Net % of investors taking higher-than-normal risk levels drops to 3-year lows (-29%)

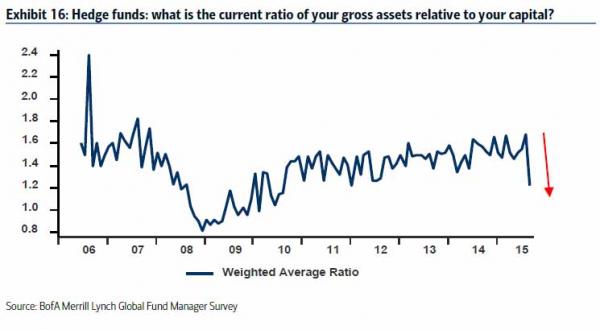

… hedge fund lead the brigade with the lowest gross asset exposure since Jun’12 (@ 1.22x)

… as hatred of energy hits all time high… or low.

BofA notes: “Unambiguous flight-to-quality”, big increase in weighting to cash, staples and bonds and a b”ig reduction in weighting to equities, Japan and the UK”

The pessimism continues: “Investors have more conviction in market “shorts” than market “longs.” Based on current positions “Contrarians would go long energy/ materials, EM/ commodities & the UK; Contrarians would short discretionary, banks, Eurozone & tech”

More flight out of risk and into cash: Cash levels back up to 5.5% (post-Lehman highs), from 5.2% last month

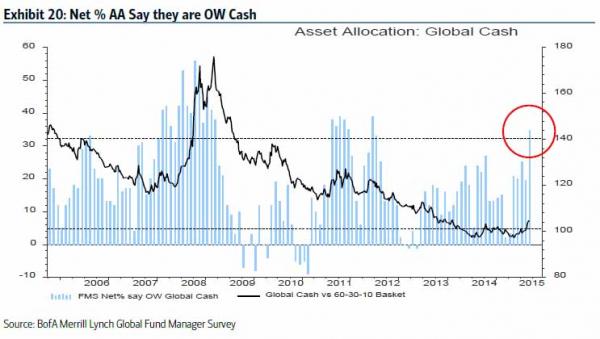

In practice, this means that the allocation to cash jumps to net 35% OW, highest since Jun’12.

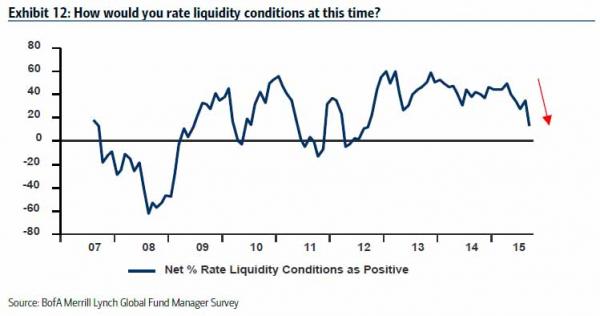

Worse, investors no longer want to be in a market in which they say liquidity conditions are “poor” or “very poor”

What does this mean for the economy? According to the following chart, the market pessimism has spread to the global real economy, which is now perceived in the worst shape since July 2012.

Bottom line: either markets soar, or something bad is about to happen: to wit:

“Unambiguous pessimism means risk assets riper for a rally (note investors don’t want a Fed hike this week). If no rally, then markets ominously hinting “recession” and/or “default” imminent.”

Leave A Comment