The chart below is a look at the short-term trend. It looks healthy, but I’m still a skeptic. The 50-day, shown in red, is the line in the sand. If we break that, I’ll be raising more cash.

I still think that the Semiconductors are critical for the market. At the moment, this chart looks good which supports stock prices overall.

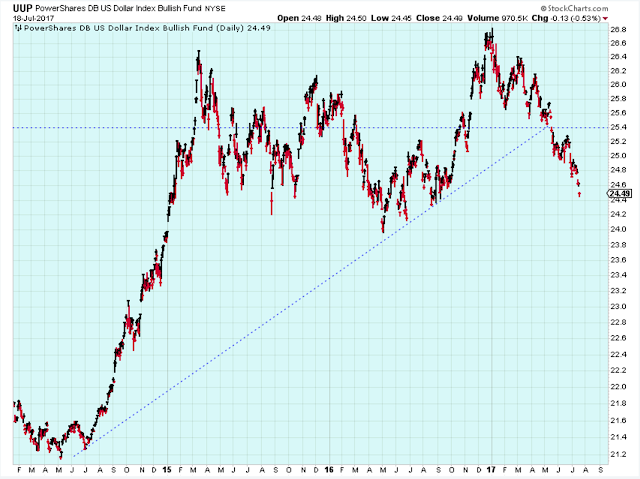

The US Dollar just can’t find a low.

The Leader List

The number of ETF leaders continue to grow. The ETFs in blue and green shown below are the leaders, but the others are very close to being included on the list.

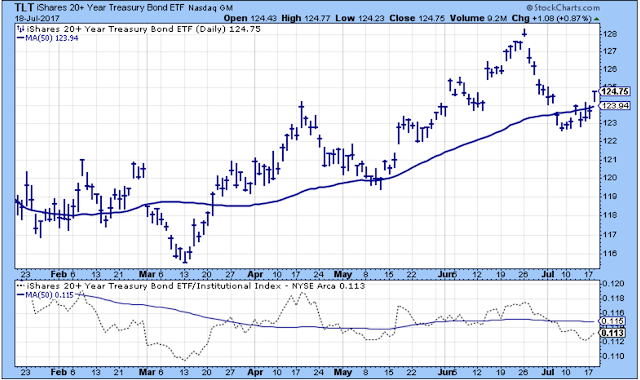

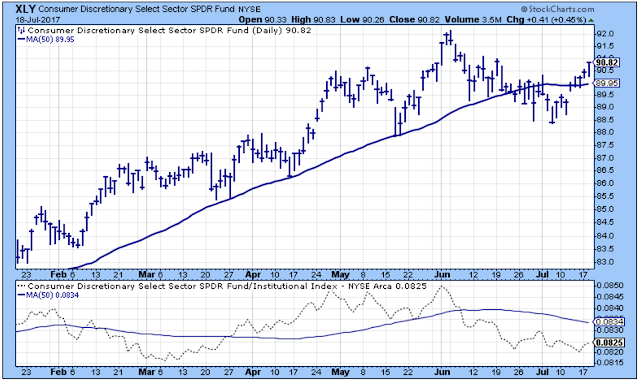

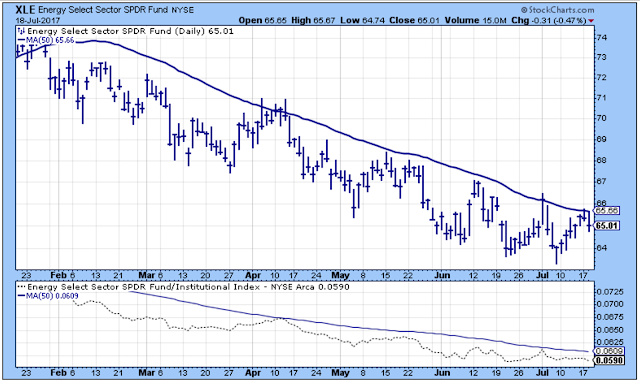

Treasuries, Technology, Consumer Discretionary were strong today. The laggards such Energy, Gold Miners, Retail, have rallied a bit off their lows.

Treasuries are showing strength again. I like this pop up above the 50-day, but TLT is still an under-performer compared to stocks.

Technology has come roaring back, and it is starting to outperform the broader market again.

Consumer Discretionary has a nice rally going, but it is an under-performer compared to the general market.

So many articles that I am reading are suggesting that investors buy Energy. I started to warm to this group, but now I have come to my senses. This ETF needs to break above the 50-day, then we take another look.

Outlook

John Murphy has pointed out that it has been a year since the market has experienced a 5% correction so it is overdue for a pullback. He also mentions that we are entering the risky time of the year for market corrections.

qThe long-term outlook is positive.

The medium-term trend is up.

The short-term trend is up as of July-12.

Leave A Comment