The US stock market had a long overdue correction in the first quarter, a response to the concern that the market had become overvalued in the raging post-election bull market. Many sophisticated investors would probably agree that a healthy pullback can propel the market forward in the long run. One of the arguments for that view is that the pullback brings an overheated market back to a so-called bargain level so that more cash will participate. However, how can one identify a market that is truly overvalued? We recommend a close look at the equity risk premium. (Data source: Bloomberg)

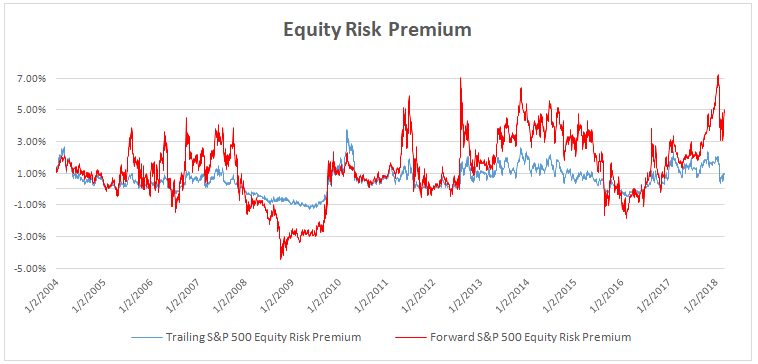

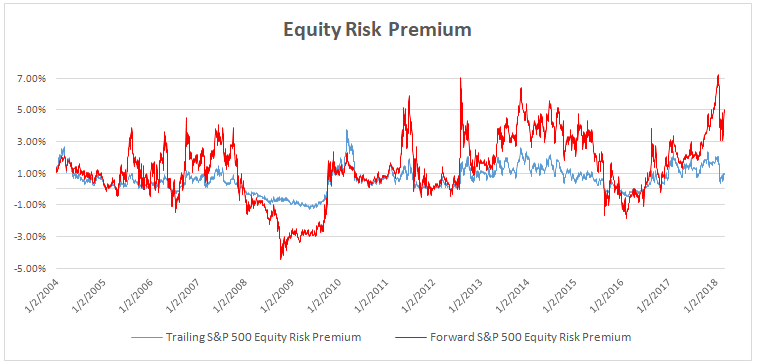

Figure 1. Trailing and Forward S&P 500 Equity Risk Premium Comparison

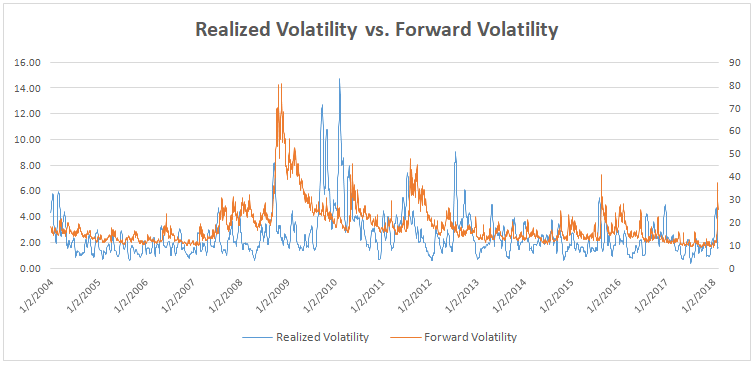

Figure 1 demonstrates the equity risk premiums in both trailing and forward measures for the past two decades. We define the trailing equity risk premium using realized volatility and use perceived future volatility to calculate the forward equity risk premium. The first takeaway is that the trailing premium is less volatile than the forward premium. This suggests that the market tends to overestimate the future violence of market movements. More importantly, this fact indicates that oftentimes the market turns out to be not as overvalued as many investors have believed. However, overestimating equity risk does not necessarily translate into overestimating volatility. In fact, forward volatility overshoots and undershoots for almost equal amounts of time, as shown in Figure 2.

Figure 2. Realized Volatility vs. Forward Volatility

Now, did the market seem to be overly valued in the month of January? The market itself thought so, according to the forward risk premium. Nevertheless, bearing in mind the evidence that the market tends to miscalculate volatility during significant price movements, we advise investors not to just simply stampede with the herd. After all, panic selling and FOMO (fear of missing out) buying will only dampen overall returns.

Leave A Comment